Boston-area renters may one day dream of owning a home in the area, but chances are, it will take a lot of planning and saving.

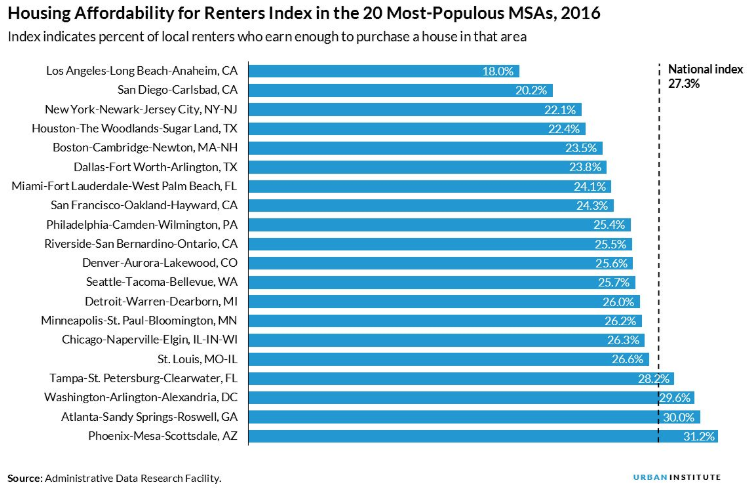

A new study by the Urban Institute shows that just 23.5 percent of Boston apartment dwellers can afford a home in the city. That is the fifth-lowest rate of any major city in the country, according to the report.

The national average for big-city renters who can afford local homes is 27.3 percent. Only four cities — Phoenix, Atlanta, Washington, D.C. and Tampa — beat the national average.

While Boston’s housing market is expensive, it is not entirely out of line with what some of its residents can afford. Boston has a high concentration of well-paying jobs and highly skilled workers. The Urban Institute does not believe Boston is headed for a housing bubble, as its 2017 housing bubble watch list put Boston at 20 out of 25 major cities.

So why can only a select few renters afford Boston homes? Mostly because there are very few homes to buy, according to the Urban Institute.

“Although Boston’s cost is high, the supply problem is what stands in the way of homeownership for these renters,” the study says.

Check out the rest of the Boston housing study here, and check out the chart showing how many renters can afford homes in major American cities below: