Today’s homebuyers are more likely to pay cash and be unmarried and childless than the typical buyer in previous years. They’re also entering their new homes with a much steeper income.

Sellers, meanwhile, said they worked with a Realtor nearly 90% of the time, and 92% of sellers were satisfied with the selling process.

Those are among the key takeaways from the annual Profile of Home Buyers and Sellers report, produced annually by the National Association of REALTORS® (NAR) since 1981. The data, from a nationally representative sample of homebuyers who purchased a primary residence from July 2022 to June 2023, offers an up-close picture of residential real estate buyers and sellers.

“This year’s report continues to show buyers encountering a housing market with limited housing inventory and affordability constraints. Other trends are likely a result of return-to-office demands,” the report said.

The report also highlighted how sellers feel about working with real estate professionals. Nearly nine in 10 homesellers chose to work with an agent, and 92% of those sellers were satisfied with the overall process.

Homebuyers over the past year

Between summer 2022 and 2023, first-time homebuyers made up 32% of all buyers, up from the previous year’s historic low of 26%. And while it’s a notable increase, that figure still is well below the 38% average looking all the way back to 1981.

And it’s not hard to see why. With increased home prices, today’s is a difficult, competitive environment for first-time buyers. Homebuyers had a median household income of $107,000 in this year’s profile, up from $88,000 the year before. That’s more than a 20% increase.

“Given the erosion of housing affordability due to higher home prices and mortgage rates, the household income for those who successfully purchased homes jumped by nearly $20,000 and topped six figures for only the second time in our records,” Jessica Lautz, NAR’s deputy chief economist and vice president of research, said in a press release accompanying the report. “In a still-competitive housing market, more well-off homebuyers were able to have their bids accepted by offering larger down payments and even by paying cash.”

Twenty percent of recent homebuyers paid cash for their home, with no financing. That’s 2% less than the previous year but still up — a lot — from the 2021 rate of 13%. Down payments also grew for both first-time and repeat buyers with first-time buyers likely needing a stronger offer against more experienced, all-cash buyers.

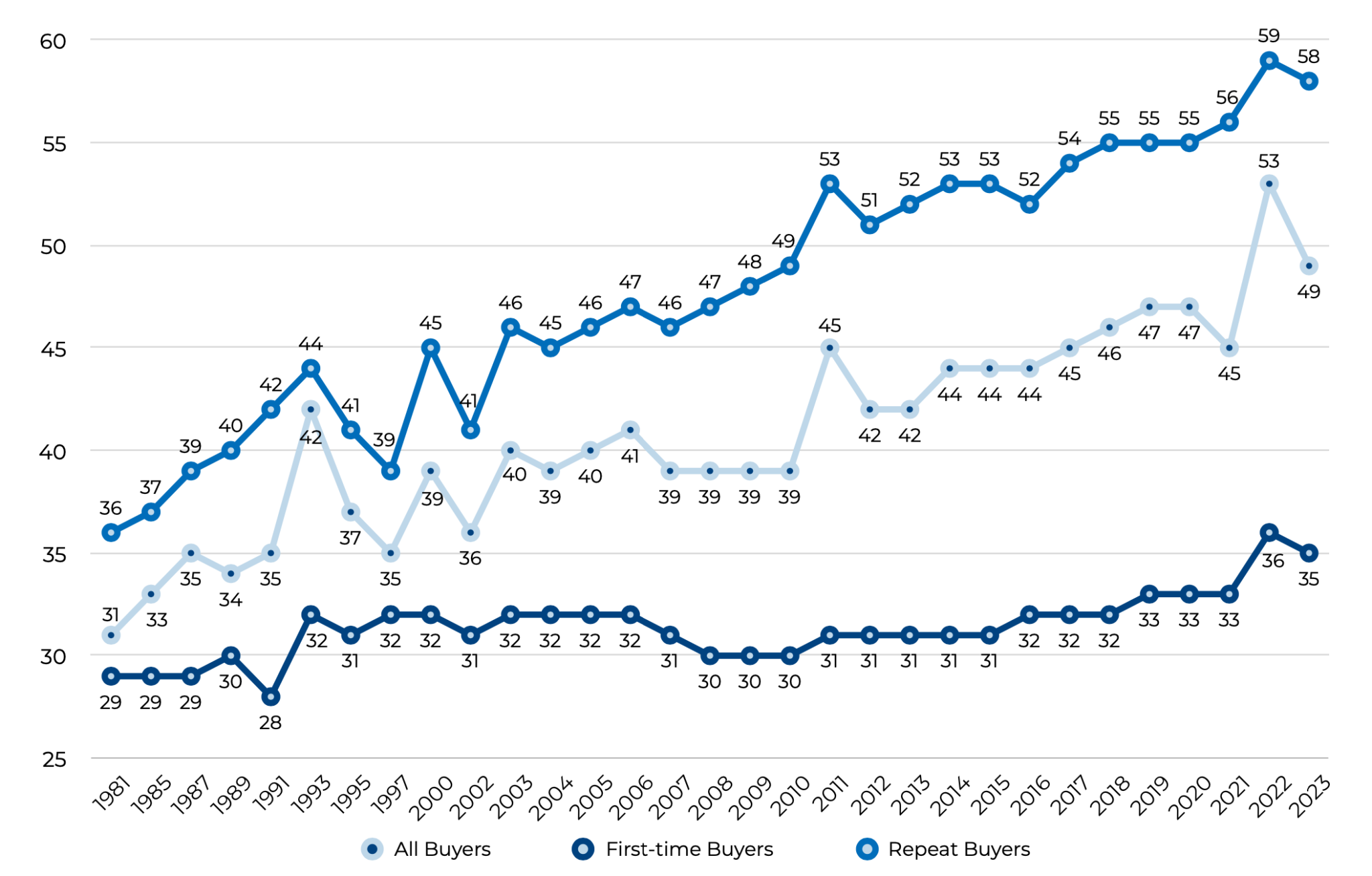

Among first-time buyers, the median age was 35 years: a slight decline from last year’s record high of 36. Meanwhile, the median age for repeat buyers also declined just a year from last year’s all-time high of 58. After 2022, these are the second-highest ages seen in the decades-long data set.

Among both first-time and repeat recent buyers, 59% were married couples, which is the lowest share of married couples since 2010. Seventy percent did not have a child under the age of 18 in their home, which is the highest share recorded. For context, in 1985, 42% of households did not have a child.

This year’s report also showed some growth in minority homebuyers. Eighty-one percent of buyers were white, a 7% decrease year over year, while 7% were Hispanic/Latino, 7% Black, 6% Asian/Pacific Islander and 6% percent identified as another race. Overall, the percentage of buyers born outside the U.S. increased 2% to 10%.

Across demographics, the overall number of weeks buyers spent searching for a home remained unchanged from 2022: 10 weeks, with buyers looking at a median of seven homes.

The median age of of homebuyers (1981–2023)

Homesellers over the past year

Although homebuyers showed slight decreases in age, year over year, the median age of homesellers in the profile remains unchanged at 60, with sellers living in their home for a median 10 years before selling. This is typical, as sellers’ median tenure was 10 years across seven years of the last decade.

However, other parts of the homesellers’ profile were more dramatic. This year, 63% percent of sellers reported moving within the same state, with a median distance of 35 miles. In 2022, just 24% of sellers moved within the state, with a median distance of 90 miles.

The desire to move closer to friends and family was the most popular reason sellers moved at 23%, followed by too-small home size (13%) and a change in the family (10%). Thirty-nine percent of sellers traded up to a larger home while 33% purchased a smaller home.

About half of sellers (48%) completed minor renovations on their home before selling and, in the end, homes remained on the market for a median of two weeks, unchanged from last year.

Eighty-nine percent of sellers opted to work with a real estate agent.

The role of Realtors

Among those 89% of sellers who used a Realtor, 65% found theirs through a referral or used an agent they had worked with before. Eighty-one percent of recent sellers contacted only one agent before moving forward.

Forty-six percent of sellers used the same agent to purchase a new home as well as sell their own, a share that increased drastically, to 84%, among sellers who were purchasing locally within 10 miles.

Seventy-five percent said they provided their agent’s compensation, and 87% said they would definitely recommend their agent.

Ninety percent of recent buyers found their real estate agent to be a very or somewhat useful information source, and 92% reported they were at least somewhat satisfied with the process.