When the COVID-19 pandemic necessitated large lifestyle changes, many homebuyers flocked to the suburbs. As work shifted to a remote basis, possibilities opened for families to live far beyond crowded urban hubs. Over the past year, outer suburbs, or exurbs, have experienced a particularly intense boom. It’s those distant areas which saw the sharpest increase in interested buyers, according to Realtor.com.

When the COVID-19 pandemic necessitated large lifestyle changes, many homebuyers flocked to the suburbs. As work shifted to a remote basis, possibilities opened for families to live far beyond crowded urban hubs. Over the past year, outer suburbs, or exurbs, have experienced a particularly intense boom. It’s those distant areas which saw the sharpest increase in interested buyers, according to Realtor.com.

Farther from big cities, the land is cheaper. Homes there — with ample space to quarantine comfortably — are more affordable to potential homeowners. And builders have also taken notice, constructing new houses in those sparser regions. And though the waning pandemic might have signaled a potential bust, the Delta variant further complicates the future of exurbs.

We’ve drastically altered our patterns for how we live and work. But how long will it continue? Will people return to working in-person, and to what extent? These are the questions that real estate experts are now asking.

Realtor.com Chief Economist Danielle Hale acknowledges that the jury is still out on the fate of exurbs. In a recent report for the site, Hale explained, “It’s possible that some areas that saw prices rise because they were particularly attractive during the pandemic might not be able to sustain those high prices… The factors that drew people to those areas, like having a lot of space and being far away from everything else, may change.” The factors that drew shoppers to exurbs were highly volatile.

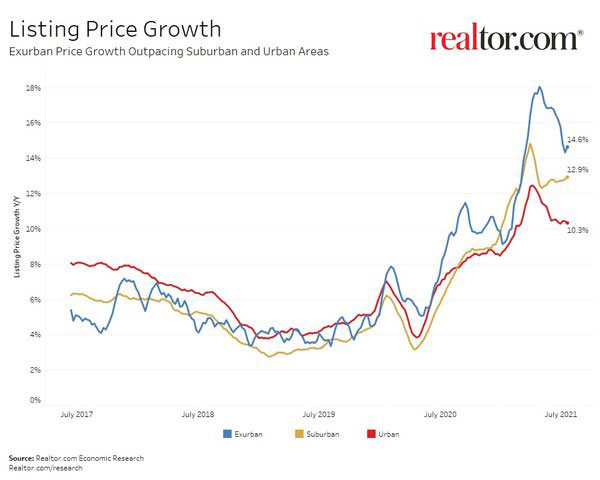

Still, Hale points out, “The desire for affordability, which is only going to become more important as interest rates go up, is going to keep interest in the suburbs and outer suburbs high. They have always been the escape valve for high city prices.” During the pandemic, interest rates fell below 3% for an average 30-year fixed-rate. Naturally, this has attracted buyers to more expensive homes. In the exurbs, price growth has outpaced both cities and the nearer suburbs. But how long prices will continue to rise? Ali Wolf, the chief economist of building consultancy for Zonda, worries that if mortgage payment become too high, “There are locals who will just get crushed.”

For now though, the lack of affordable options in cities as well as those closer suburbs is keeping exurb demand high. “It’s not a new phenomenon that, when people can’t afford the city, they look further out,” Hale points out. Additionally, the possibility to work from home appears to be sticking around. “Everyone’s not going back to the office five days a week anytime soon,” says Kelly Mangold, a real estate economic specialist for RCLCO. “I don’t think prices will drop off dramatically.”

And aside from residential remote workers, there are investors seeking to flip or rent out exurb properties. Commenting on that phenomenon, Devyn Bachman, the vice president of research at John Burns Real Estate Consulting, predicts healthy price appreciation. Although “you may see some small corrections in these markets,” he says. Experts are not expecting the exurb market to fully crash. Unlike in the mid-2000s real estate bubble, demand is still outpacing supply.

Then again, maintaining such large properties is expensive. It’s key to note some potentially risky factors of exurb home ownership: sprawling square footage and big yards result in extra care and higher heating bills. Overbuilding in those areas does not seem likely — even while the open spaces of exurbs entice building prospects. In the second quarter of 2021, about 9.2% of single-family home construction took place in the exurbs of big cities, according to the National Association of Home Builders, and 8.9% of construction occurred in the exurbs of medium-sized cities.

Increasing the number of exurb homes and residents, in turn, attracts commerce: stores, restaurants and more. So as amenities and available homes both continue increasing, it’s entirely possible the exurb housing market will remain strong — so long as supply does not start outweighing demand.