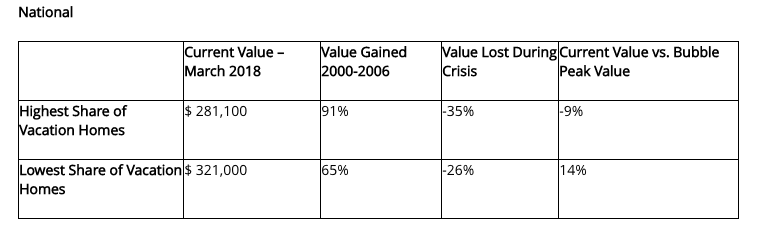

Vacation home markets are recovering slower than most from the housing market crash. According to a report from Zillow, markets with a high density of vacation homes are still 9 percent below their peak value before the crash. Meanwhile, areas with a low density of vacation homes are 14 percent above the peak value.

Source: Zillow

“Vacation home markets have lagged the rest of the country during the economic recovery, despite an exaggerated boom and bust a decade ago,” Zillow senior economist Aaron Terrazas said. “As the economy improves and more Americans feel secure in their personal finances and primary residences, it is possible that more will look to buy a vacation home.”

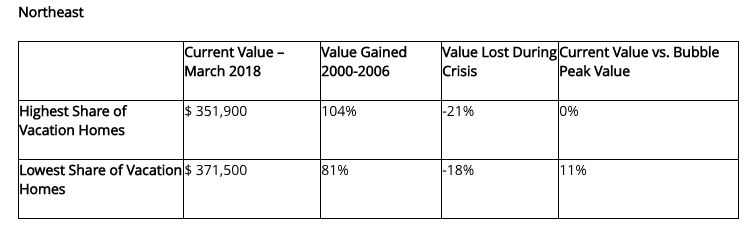

For some Americans, the risk of natural disasters and recent second-home tax hikes may outweigh the value of having a vacation home. After losing 21 percent of its vacation home value during the crash, the Northeast has finally managed to break even. The current value of high density vacation home markets is equal to peak pre-crisis value.

In every region, markets with a low density of vacation homes are valued above their peak bubble value.

Source: Zillow