Home prices were up again in July, according to a new report from CoreLogic.

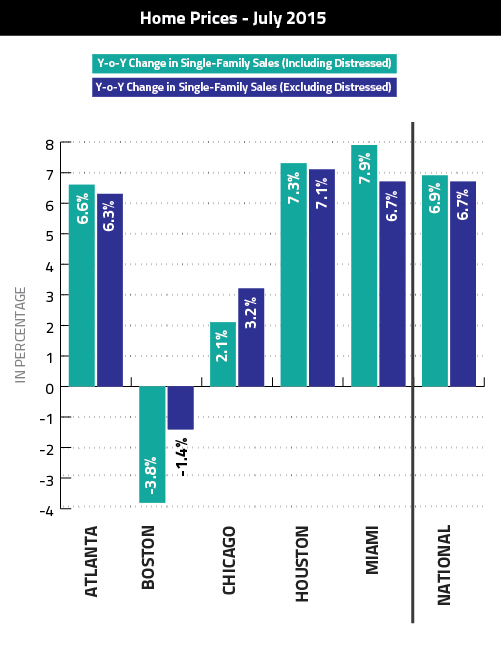

Year-over-year, home prices, including distressed sales, jumped 6.9 percent nationwide, while excluding distressed prices increased 6.7 percent.

The price increases reflect an overall strengthening of the nation’s economy, and particularly a stabilizing housing market that is experiencing the overwhelming foreclosure congestion and crippling low inventories of the past. Those issues, however, still exist in a few specific areas.

In Boston, where the city has become an outlier in several housing metrics, home prices are actually declining. In July, home prices, including distressed sales, fell 3.8 percent year-over-year, and excluding distressed, prices fell 1.4 percent. It was a similar case statewide, where prices, including distressed, dropped 2.1 percent.

The numbers, though, might be somewhat misleading, as lenders have recently been working through a backlog of foreclosures, which are now hitting the market – likely at reduced prices. Those transactions are probably the culprit driving home price averages down.

Near Universal Growth

In CoreLogic’s report, researchers examined data from every state, and found that the overwhelming majority experienced positive price growth in July compared with a year prior.

- Including distressed sales, the five states with the highest home price appreciation were: Colorado (+10.4 percent), Washington (+9.9 percent), Nevada (+9.1 percent), Hawaii (+8.9 percent) and Oregon (+8.8 percent).

- Including distressed transactions, the peak-to-current change in the national Home Price Index (from April 2006 to July 2015) was -6.6 percent. Excluding distressed transactions, the peak-to-current change for the same period was -3.5 percent.

Consumer Confidence Soars

In a statement accompanying its home price report, CoreLogic President and CEO Anand Nallathambi credited the market’s continued improvement to more available financing and a resurgence of consumer confidence.

“Low mortgage rates and stronger consumer confidence are supporting a resurgence in home sales of late,” he said. “Adding to overall housing demand is the benefit of a better labor market which has provided Millennials the financial independence to form new households and escape ever rising rental costs.”