CoreLogic’s May distressed sales report shows lowest levels since 2007

CoreLogic recently released a new report detailing the state of the distressed sales market in the U.S. for May, and for another month, both real-estate owned (REO) and short sales saw their market shares drop. Overall, distressed sales market share dropped 2.8 percentage points year-over-year to its lowest point for the month of May since 2007.

In Jan. 2009, when distressed sales were at their peak, holding a 32.4 percent share of all sales, the majority were comprised of REO sales (27.9 percent). Since that time, the market relevance of REOs has waned considerably. In May, REO sales accounted for only 6.4 percent of total home sales – the lowest level since Oct. 2007 when REO sales were at 6 percent.

Short sales in May accounted for 3.5 percent of total sales. In Mid-2014, short sales dipped below 4 percent, and since that time levels have remained stable.

In the report, CoreLogic projections suggest that at the current pace, distressed sales share should return to pre-crisis levels of about 2 percent by mid-2018.

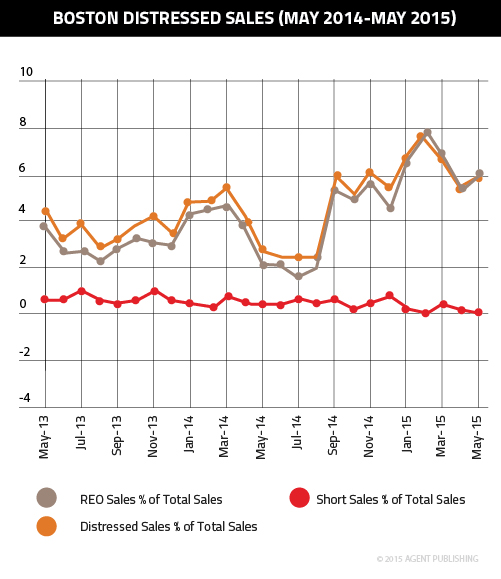

In Boston, distressed sales have taken a course opposite the nation’s. Over a two-year period, distressed sales are up. However, as Radius Financial Group President Sarah Valentini recently said in a Viewpoints interview, the uptick in distressed sales, particularly foreclosures, is the result of Boston working through a backlog.

“There remains a backlog of foreclsoures as regulations were being finalized,” she said. “These are not ‘new’ foreclosures, but ones where paperwork was not processed as lenders did not want to risk any missteps.”

Still, despite the increase, levels for both REO and short sales remain below national levels, particularly short sales, which held a 0.04 percent market share in May.