Trends

For data-driven stories, to appear under “Trends” menu

Boston is one of the most expensive cities for single-family rents in the nation, according to a new report.

The median existing-home price for all housing types in December rose 6% from its year-ago level.

For the first time in two years, home prices are on the rise in every major metro and Boston is one of them, according to a new Redfin report.

The median price of a single-family home in Massachusetts reached an all-time high last year, according to the Warren Group’s December market report.

Nationally, home sales were up 13.3% year over year and 4.4% month over month, RE/MAX said.

Zillow has released its list of the hottest real estate markets predicted in 2025, and Boston has made the rankings.

Housing market research company Zonda’s 2025 list focuses on wealth and the high-end market.

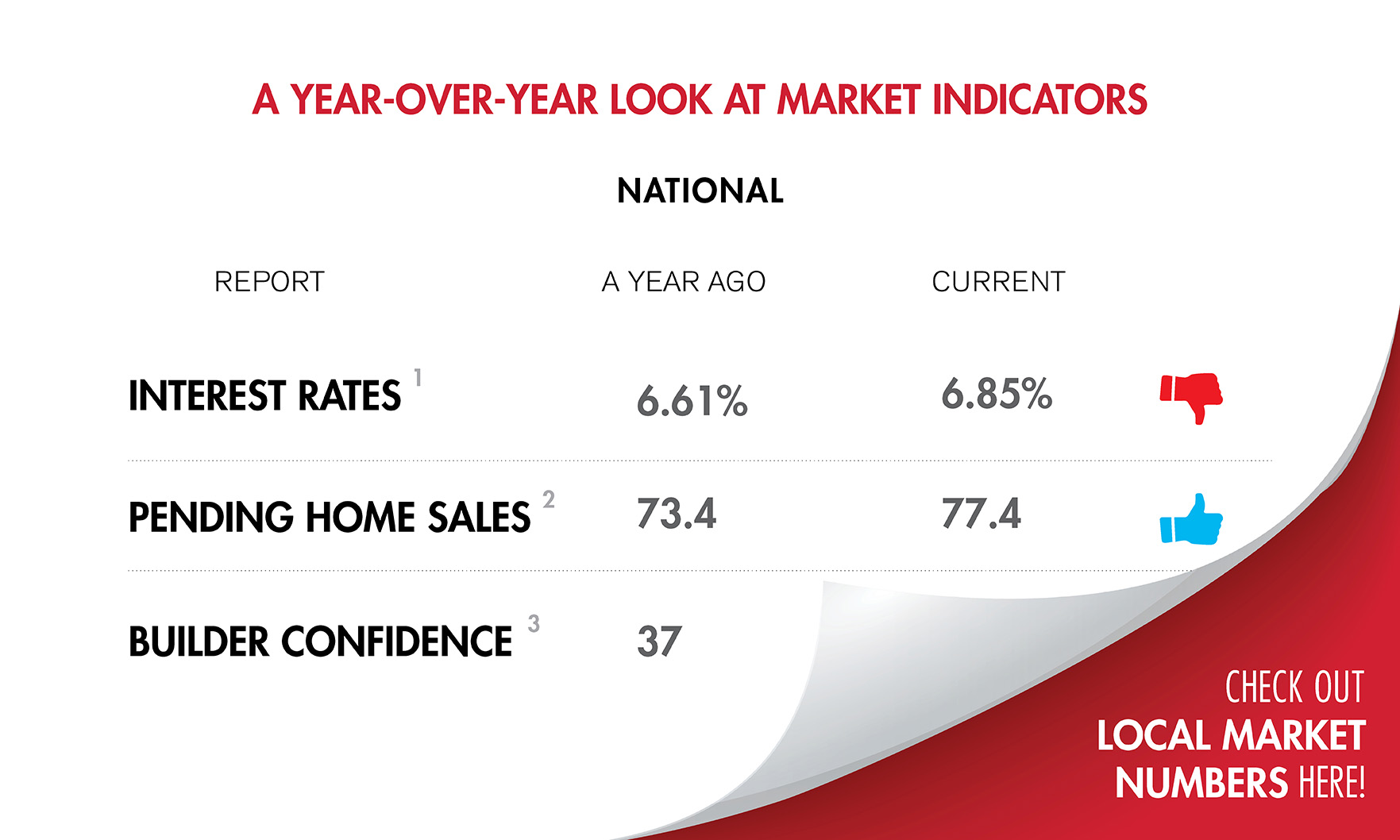

Nationally, pending home sales and builder confidence also rose in December.

In its last reading before the end of the year, the National Association of REALTORS® Pending Home Sales Index posted its fourth consecutive monthly increase in November.

The median-sales price slid from $425,600 in October to $402,600 last month.

The year-over-year increase of 6.1% is the greatest since June 2021, according to the association.

Massachusetts home and condominium sale prices reached all-time highs for the month of November, according to the Warren Group’s November 2024 Sales Report.

On a monthly basis, however, sales were down 13.3%, RE/MAX said.

A year-over-year boost in closed sales last month signals a strong outlook for buyers and sellers, according to the Massachusetts Association of Realtors (MAR) November market report.

More buyers are touring homes and applying for mortgages as the 2024 housing market enters its home stretch, according to a new Redfin report.

Taylor Swift’s cultural impact has moved beyond music and fashion into the design of ultra-high-end real estate.