Current Market Data

U.S. single-family rent growth exceeded pre-pandemic rates in November, according to latest CoreLogic report.

The flight to the suburbs has become a growing preference for buyers, but renters are also finding respite in the outskirts of larger metro areas. That could help continue to drive new construction of apartments in suburbs across the country, according to a new report from Rent Cafe.

The Houzz 2021 Kitchen Trends Study highlights post-pandemic must-haves.

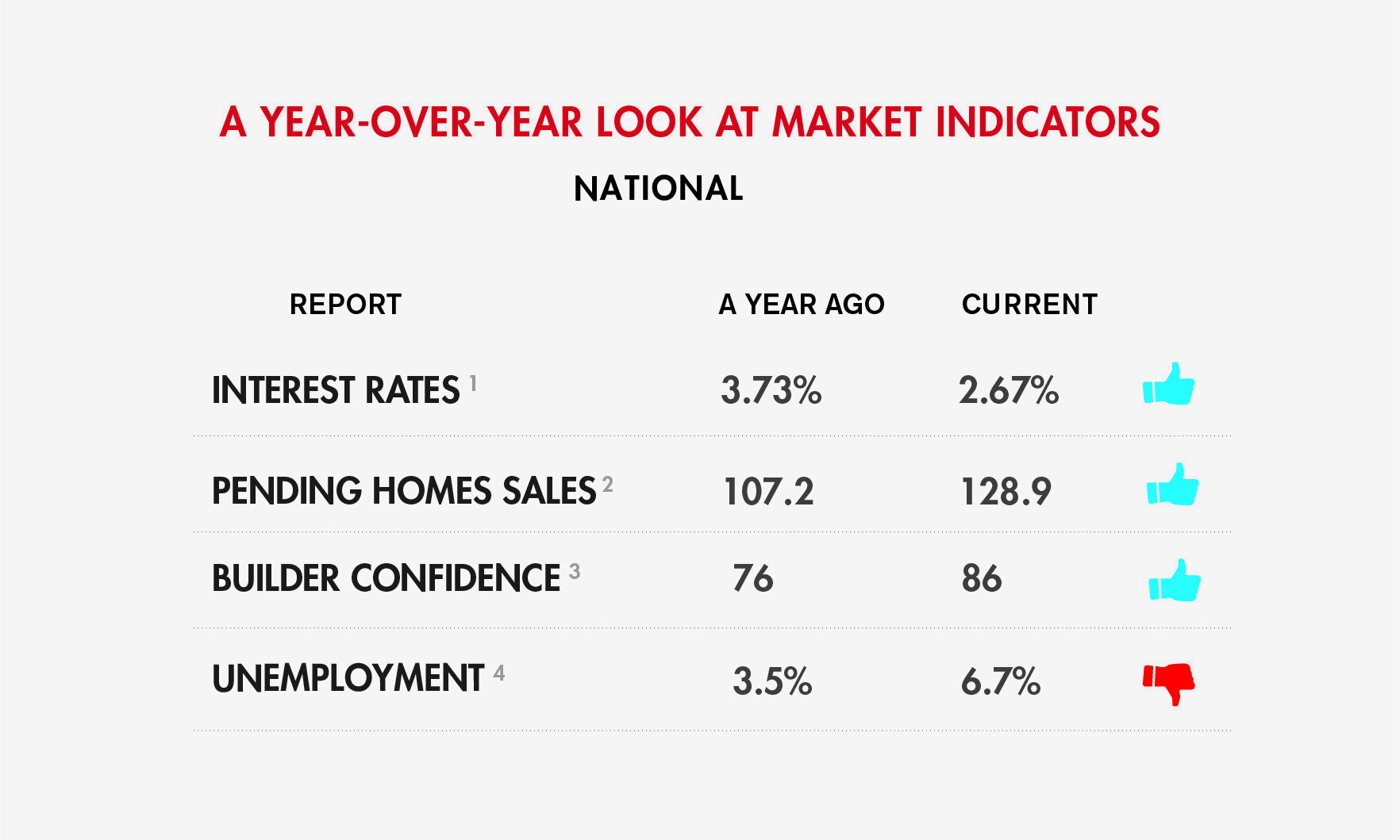

The decline of home mortgage interest rates is continuing to fuel homebuying demand in December, pushing the median home-sale price up 13% nationwide to $334,300, according to a new report from online broker Redfin.

See which metro cities experienced rent increases over the last 12 months.

The report analyzed all sales in the Boston metro area between 2009 and 2019 and calculated the median sales price for each neighborhood.

Here’s a little tidbit that might help clients decide whether or not it’s time to buy their first home — it could save them some money.

December marked the end of seven straight months of job growth.

Want to know what’s happening in the Boston market? Click here for the full housing scorecard to see your local numbers!

The number of homes for sale nationwide dropped below 700,000 in December, hitting an all-time low, while home prices were up double-digits over the year prior, according to realtor.com’s Monthly Housing Trends Report.

As the housing market heated up this summer, selling to an iBuyer became a less attractive option for many profit-minded homeowners.

“Comparing the RHPI levels in October relative to the resurgence of home buyer interest in June, affordability declined in 24 of the top 50 markets we track.”

Sales in November are still 25.8% higher year over year.

Inventory also reached its lowest point in the report’s history, down 31.8% from the same time last year and down 13.3% from October.

Strong underlying fundamentals shaped the housing market’s remarkable 2020 comeback story and, with a vaccine rollout underway, the stage is set for another strong year in 2021, says First American Chief Economist Mark Fleming.

“Nothing sells like a shortage. We have underbuilt new housing relative to demand for a decade. Building will have to exceed household formation for a number of years to reduce the housing stock ‘debt’ we have accumulated.” — First American Deputy Chief Economist Odeta Kushi