A new Redfin report shows that since 2012 single women have earned about 92 cents for every dollar of home equity earned by single men.

In an analysis of 79,517 homes purchased in 18 of the largest cities by single women in 2012, women earned a median $171,313 in home equity by 2017. While men had earned a median of $186,403 — a difference of 8.1 percent or approximately $15,000.

Boston ranked among one of the worst cities for single women to buy homes in with a staggering $50,000 difference between equity earned for men and women.

Besides making more in the workplace on average, men seem to also spend more on homes than women; one reason behind the gap increasing between genders in homeownership. The median price of homes bought by women was $195,000, while for men it was $220,000. That’s about $25,000 more than their female counterparts.

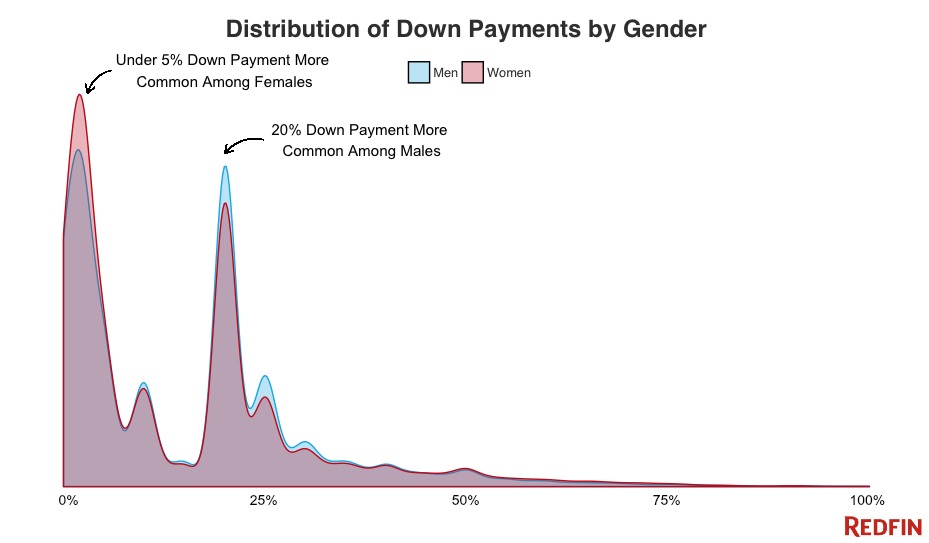

Another factor that plays into home equity is the initial down payment on a home. While Redfin reports that the median down payment for both men and women was 20 percent, the distribution graph shows a higher spike at 3.5 percent down for single female buyers and a higher spike at 20 percent down for single male buyers.

A third potential cause for this gap is that because women are more likely than men to attend college and accrue debt. Women hold nearly 65 percent of the United States’ $1.3 trillion of student debt. A study out of the American Association of University Women presented that it took women, on average, two years longer to pay off that debt. On top of that, the 2016 Census report on child support showed that 82.5 percent of single parents with custody were women.

Redfin recommends that single women looking to build equity should plan ahead by speaking with a financial planner as soon as possible, save for a larger down payment, make larger mortgage payments whenever possible and to shop around for financing.