Trends

For data-driven stories, to appear under “Trends” menu

September’s reading of 76 was up one point from August, despite lingering challenges with labor and the building-material supply chain, the National Association of Home Builders reported, citing the latest NAHB/Wells Fargo Housing Market Index.

Month over month, home sales were down 3.5%, and the median sale price declined 1.2% to $335,000.

According to Realtor.com’s Best Time to Buy Report, between Sept 12 and Oct. 17 is the best time to sell a home in most markets, but what about in Boston?

August home sales fell for the first time in 12 months as median sales prices of both single-family homes and condominiums declined or stayed flat last month.

Wonder where Boston residents are headed? You might be surprised.

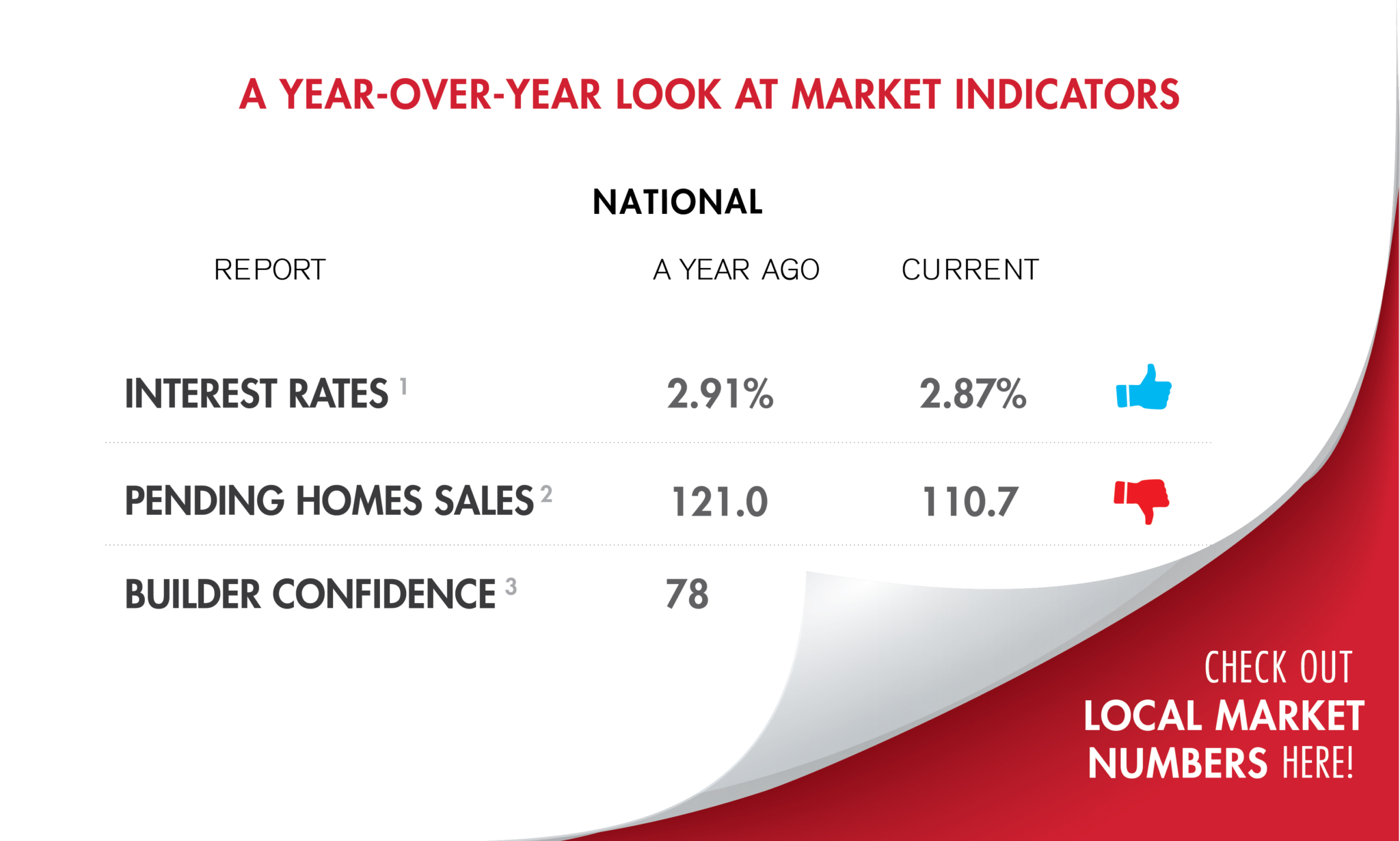

Pending home sales in August rose just 9%, the slowest growth since June 2020, according to a new Redfin report.

A decline in new home listings has had little impact on the market as far as demand is concerned, according to a recent Redfin report.

Income levels and mortgage rates gave homebuyers in June 129% more house-buying power than they had in 2006, according to First American Financial Corp.’s June Real House Price Index.

Income levels and mortgage rates gave homebuyers in June 129% more house-buying power than they had in 2006, according to First American Financial Corp.’s June Real House Price Index.

Housing inventory fell in Boston during August, while housing starts and existing-home sales rose.

Massachusetts homebuyers should brace themselves amid expectations the residential real estate market could see double digit growth next year.

Also during the month, the median sales price rose to $390,500 from $370,200 in June, according to the U.S. Census Bureau and the Department of Housing and Urban Development.

“Much of the home-sales growth is still occurring in the upper-end markets, while the mid- to lower-tier areas aren’t seeing as much growth because there are still too few starter-homes available.” — NAR chief economist Lawrence Yun

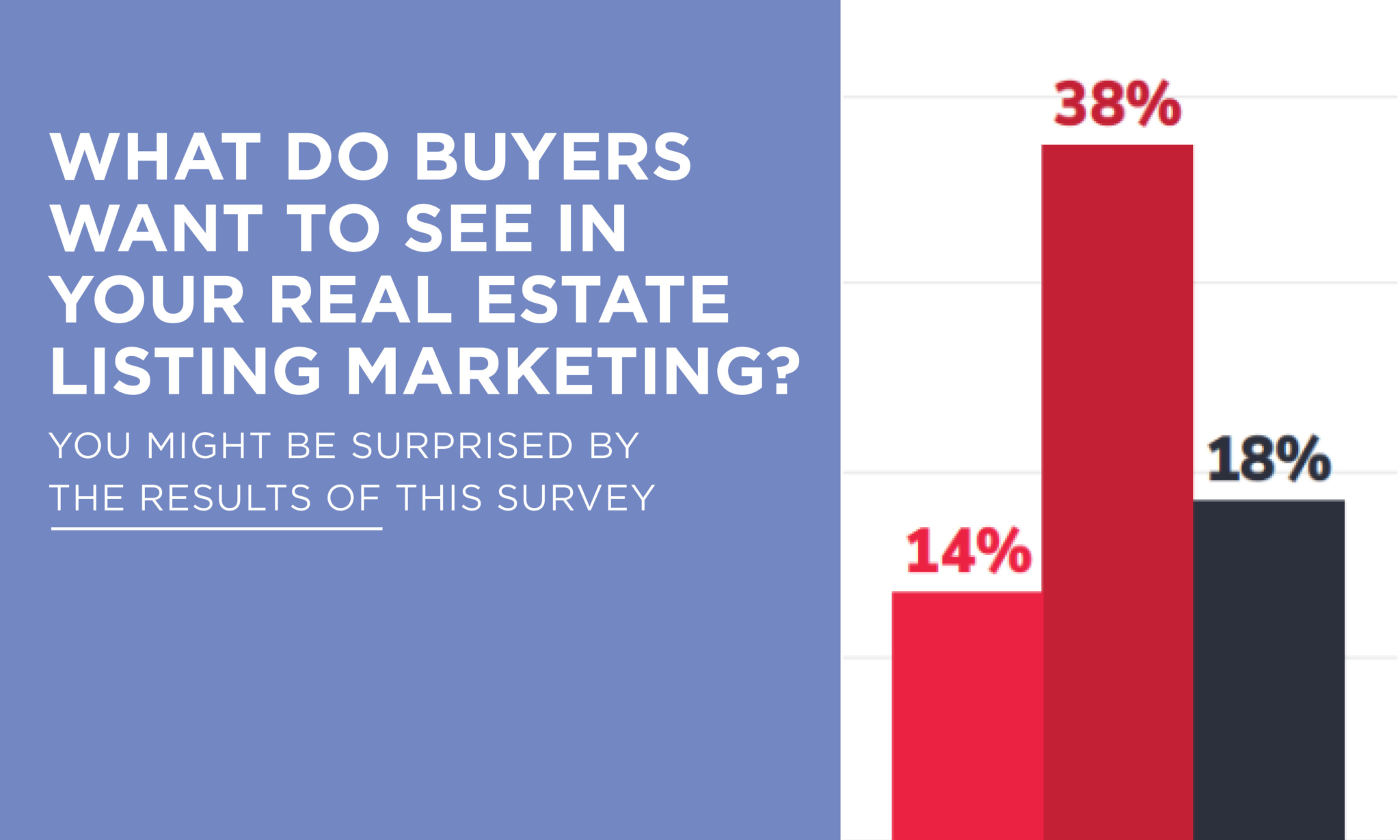

You might be surprised by the results of this survey.

“The bright spot in an otherwise underwhelming report comes from the increase in the overall number of permits issued, which can signal how much home construction is in the pipeline.” — First American deputy chief economist Odeta Kushi

Single-family and condo sales both grew month over month, but also saw decreases in volume as the market shows signs of relaxing.