Trends

For data-driven stories, to appear under “Trends” menu

Boston will experience the slowest multifamily inventory growth since 2013 this year, according to Marcus & Millichap’s 2026 Boston Multifamily Investment Forecast.

Middle-income seniors stand to be affected most by projected shortages — those who don’t qualify for subsidized housing but can’t afford new construction.

Affordability challenges continue to bedevil homebuyers, despite mortgage rates falling to a three-year low, the National Association of Home Builders reported.

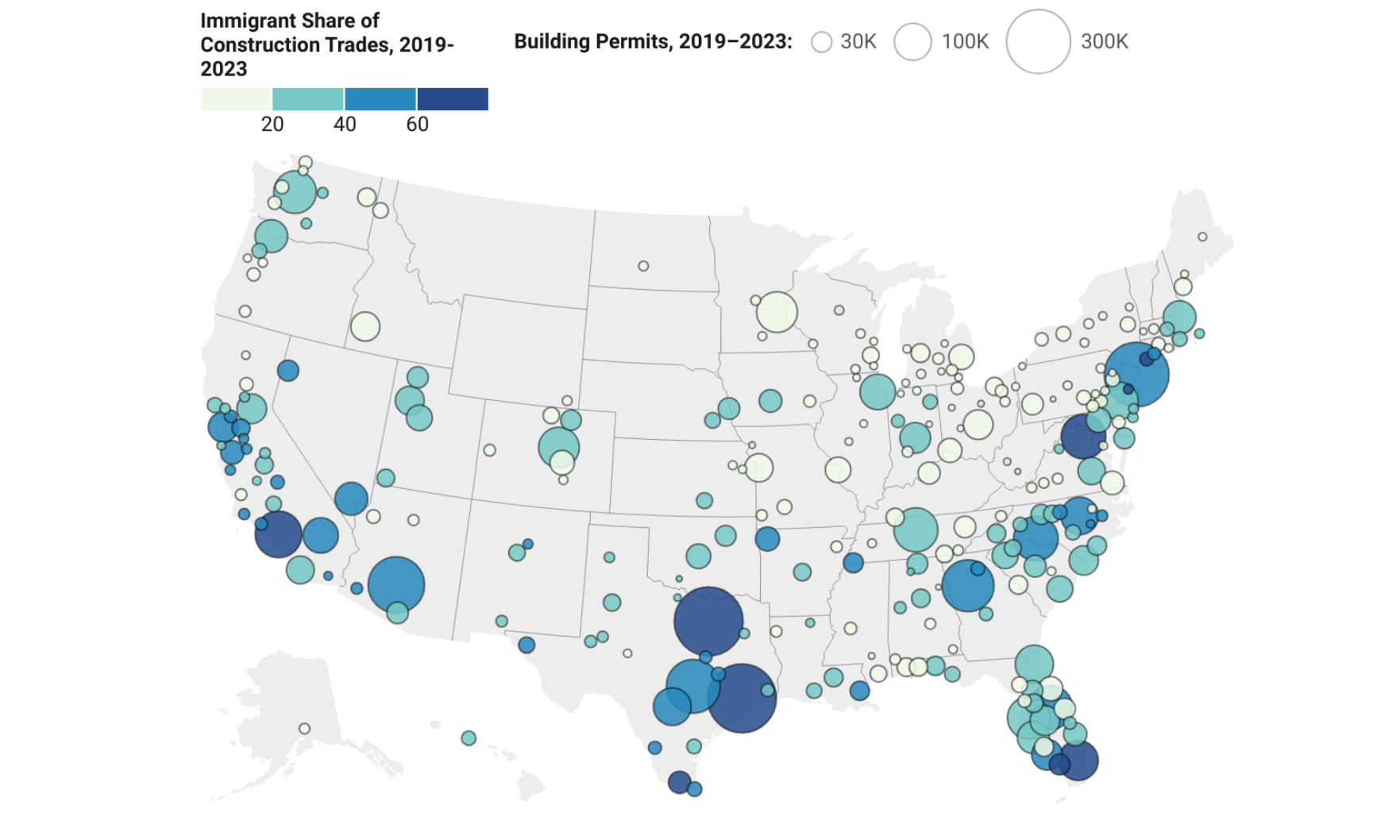

Research showed a disproportionately high share of foreign-born workers active in the construction trades nationally in 2024.

Sales of existing homes jumped 5.1% month over month, topping analyst expectations.

Access to musical events, industry jobs and music schools might drive Boston’s high artist population.

Contract signings were up in all four U.S. regions.

Evidence points to home shoppers prioritizing the experiences they’ll have in their home over the style or size, Zillow said.

The NAHB’s monthly survey found the nation’s homebuilders remain optimistic about home sales next year.

Midwestern and southern metros may dominate buyer interest in 2026, according to the National Association of REALTORS®.

Geographically, trends varied widely, with formerly hot areas like Florida and the Southeast posting the deepest declines and formerly cool areas, like the Midwest, showing healthy gains.

Spa-style amenities, customizable lighting options, integrated technology, storage solutions — and ample space for these features — all surfaced as top trends.

By region, sales rose in the Midwest, Northeast and South but fell in the West.

Bold, geometric designs like chevrons, sunbursts, zigzags and stepped shapes are making a huge comeback as of late — and Houzz said that will continue into 2026.

The chief economist for the National Association of REALTORS® also predicts home prices will climb 4% compared to 2025.

Boston climbed four spots in the rankings last year, from No. 9 to No. 5.