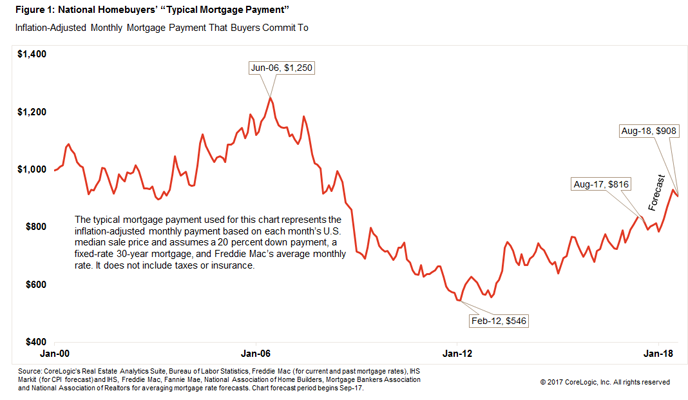

With home prices on the rise, average monthly mortgage payments have seen even larger increases over last year. According to a CoreLogic study, the typical mortgage payment for homeowners has risen 10 percentage points in 2017, with a projected increase of 11 percent by 2018. Meanwhile, the average home price saw a more modest increase of just 6 percent, according to the study.

According to the study, the typical mortgage payment has trended higher in recent years, but historically, they’re still lower than they were back in 2006. The all-time high average monthly payment was $1,250 in June 2006, which is 34.7 percent more than it is now, according to the study. The average mortgage rate back then was 6.7 percent, while now it’s 3.9 percent.

By August 2018, inflation, housing income and mortgage rates are expected to increase, causing the median home sale price to increase an expected 3 percent, according to CoreLogic. Taking all these factors into account, the typical mortgage payment for August 2018 is expected to increase 11.3 percent to roughly $908 per month from $816.

Accounting for inflation, mortgage rates and home prices, CoreLogic used fixed mortgage data from Fannie Mae to assess how much individuals will pay per month based on their home’s median sale price based on historical trends. It’s based on Freddie Mac’s average rate on a 30-year fixed-rate mortgage with a 20 percent down payment.