Trends

For data-driven stories, to appear under “Trends” menu

“MBA expects solid growth in purchase activity this year, as demographic drivers and the strong economy support housing demand,. However, the strength in growth will be dependent on housing inventory growing more rapidly to meet demand.” — Mortgage Bankers Association associate vice president of economic and industry forecasting Joel Kan

United Van Lines 45th Annual National Movers Study found the reasons behind the moves are pandemic-driven as people look to relocate to lower density areas and closer to family.

At the same time, the average 30-year fixed-rate mortgage rose to 3.33%, its highest level since April 2021, the Mortgage Bankers Association said.

Stacker compiled the list of the most expensive homes in the Boston-Cambridge-Newton area using Zillow’s Home Values Index as of November 2021.

Inflation concerns are influencing plans for homebuyers and sellers, according to a recent Redfin survey.

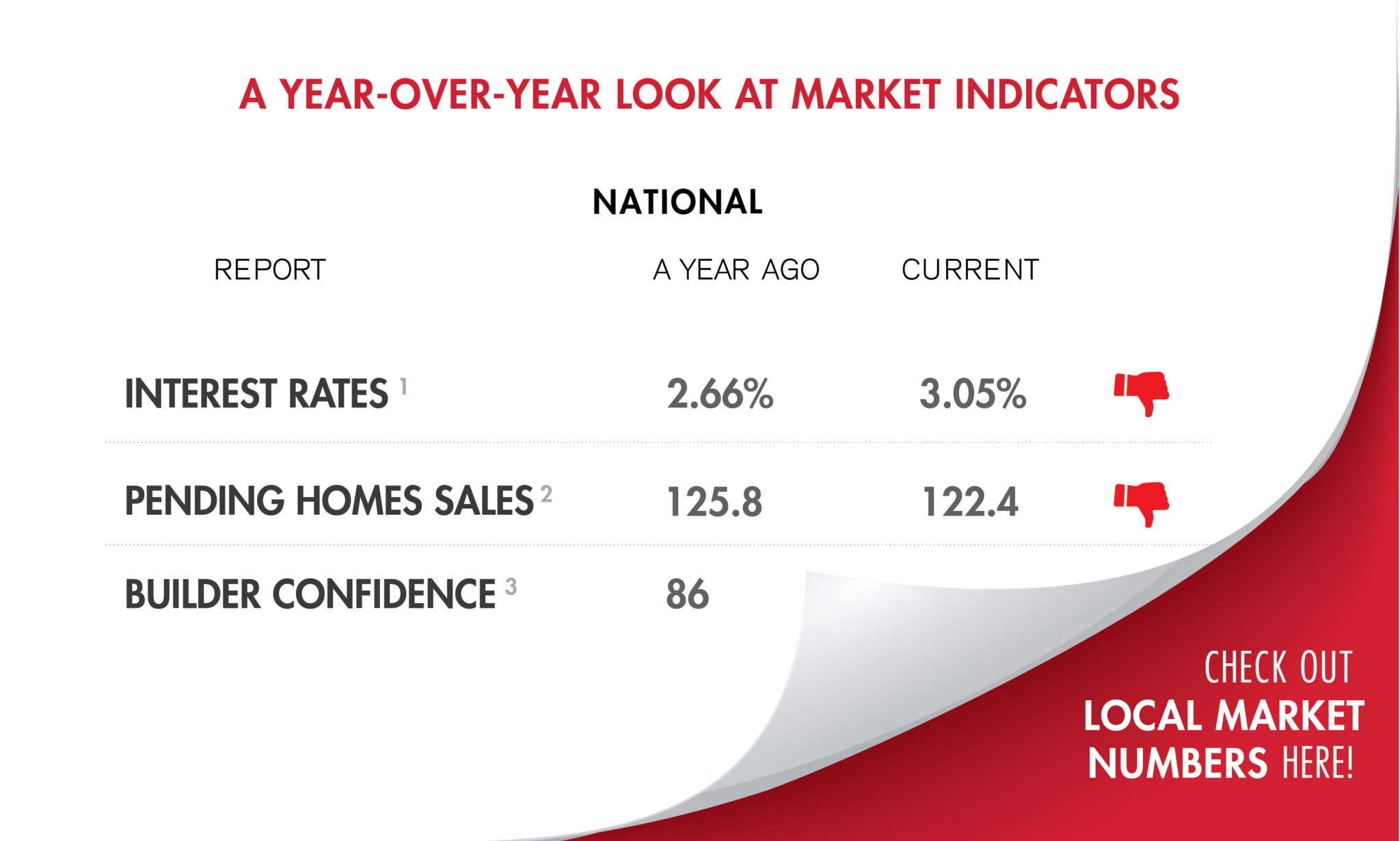

Nationally, interest rates rose as builder confidence fell.

Housing affordability fell to its lowest level since 2008 in October as home prices rose 19.6% from last year.

Nationally, housing prices were also on the rise, according to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index.

Boston ranked third among large U.S. cities for the highest median one-bedroom monthly rent at $2,550 in December.

“There was less pending home sales action this time around, which I would ascribe to low housing supply, but also to buyers being hesitant about home prices,” National Association of REALTORS® chief economist Lawrence Yun said.

The median sales price of new homes hit a new high of $416,900.

The median existing-home sales price for all housing types rose again on an annual basis, marking 117 consecutive months of gains.

“The market is roaring along, with only half the seasonal slowdown we typically see from October to November.” — RE/MAX LLC President Nick Bailey

The pandemic and work-from-home orders have changed where, when and why people buy homes. As a result, housing prices hit the highest median of all time in 2021, as the number of homes for sale fell to an all-time low and the demand for second homes surged, according to a new Redfin report.

“November’s housing starts report signals strength for the housing market.” — First American deputy chief economist Odeta Kushi

In unveiling its predictions, the National Association of Realtors also released its top 10 housing-market “hidden gems” for 2022.