By the Numbers

The pace of new home listings is gaining steam, a welcome development in the face of high demand from buyers, Redfin reported.

“Given the situation in the market — mortgages, home costs and inventory — it would not be surprising to see a retreat in housing demand.” — NAR chief economist Lawrence Yun

“Builders are entering 2022 with backlogs that they are having a hard time completing due to material and labor shortages, and new-home prices are sitting near a historic high.” — First American Deputy Chief Economist Odeta Kushi

Mortgage applications fell more than 13% in the most-recent week tracked by the Mortgage Bankers Association’s Market Composite Index, while interest rates continued to rise.

“Production disruptions are so severe that many builders are waiting months to receive cabinets, garage doors, countertops and appliances.” — NAHB Chairman Jerry Konter

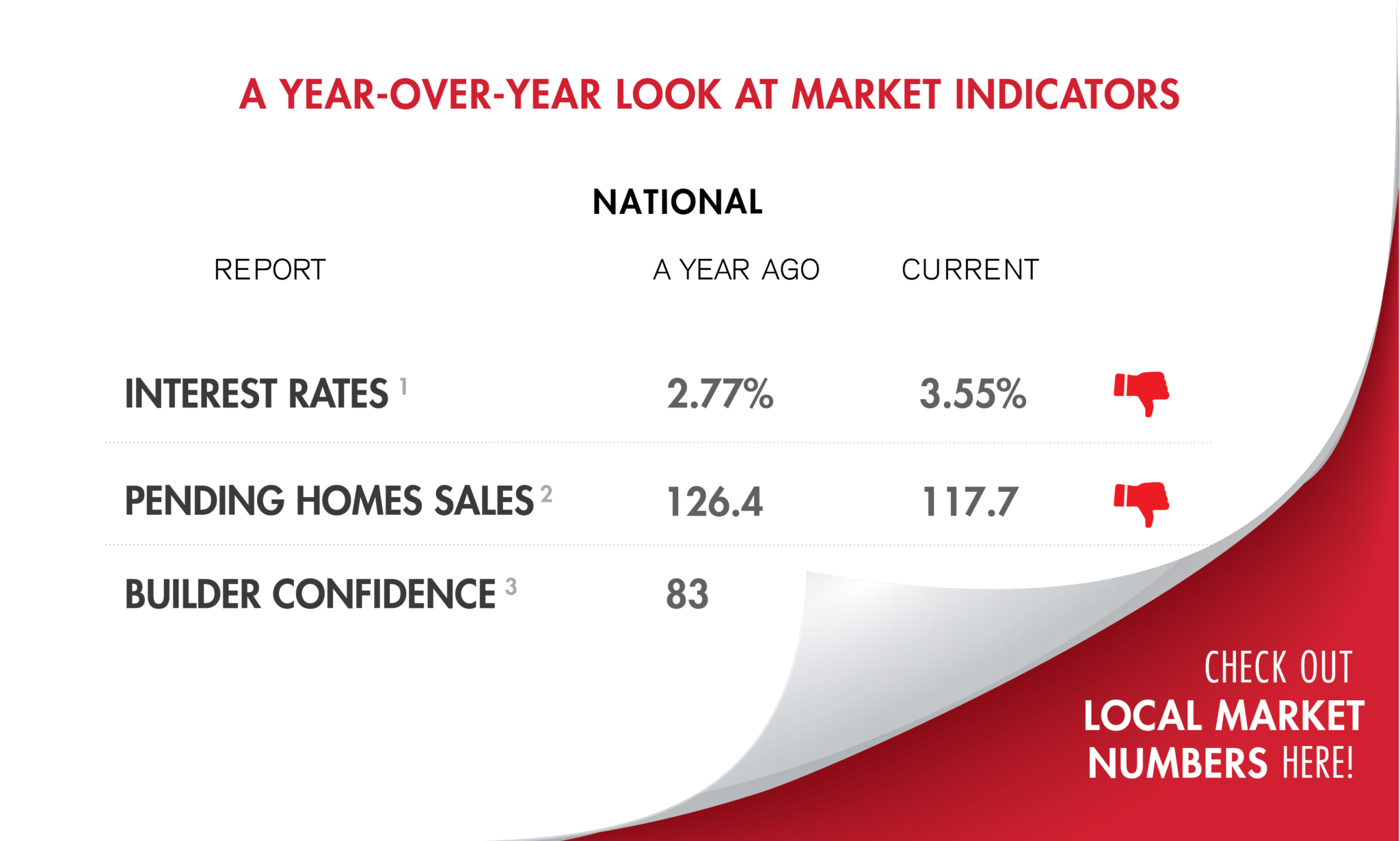

The sales pace of existing homes surged 6.7% in January after falling in December, as buyers got off the fence and went shopping ahead of rising interest rates, the National Association of Realtors reported.

Single-family housing starts fell 5.6% from December’s revised estimate to 1,116,000, while multifamily starts slid 2.1% to 510,000, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development said.

The average contract interest rate for 30-year fixed-rate mortgages backed by the Federal Housing Administration increased to 3.93% from 3.86%, the Mortgage Bankers Association said.

Home-price growth is expected to average about 5% this year, far below the record-breaking pace set in 2021, RCLCO reported.

Nationally, pending home sales fell as interest rates rose last month.

Builders started to make headway against supply-chain issues that have hampered construction of homes in the face of high demand.

“December saw sales retreat, but the pull back was more a sign of supply constraints than an indication of a weakened demand for housing.” — NAR chief economist Lawrence Yun

While multifamily starts surged 13.7% compared to November, the pace of new single-family housing construction slid 2.3%, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

“While lean existing home inventory and solid buyer demand are supporting the need for new construction, the combination of ongoing increases for building materials, worsening skilled labor shortages and higher mortgage rates point to declines for housing affordability in 2022.” — NAHB Chairman Chuck Fowke

The cost of living has risen across the nation, but some U.S. metros have experienced particularly significant increases.

“MBA expects solid growth in purchase activity this year, as demographic drivers and the strong economy support housing demand,. However, the strength in growth will be dependent on housing inventory growing more rapidly to meet demand.” — Mortgage Bankers Association associate vice president of economic and industry forecasting Joel Kan