By the Numbers

Single-family home starts declined compared to February, while new apartment construction was up, according to government statistics.

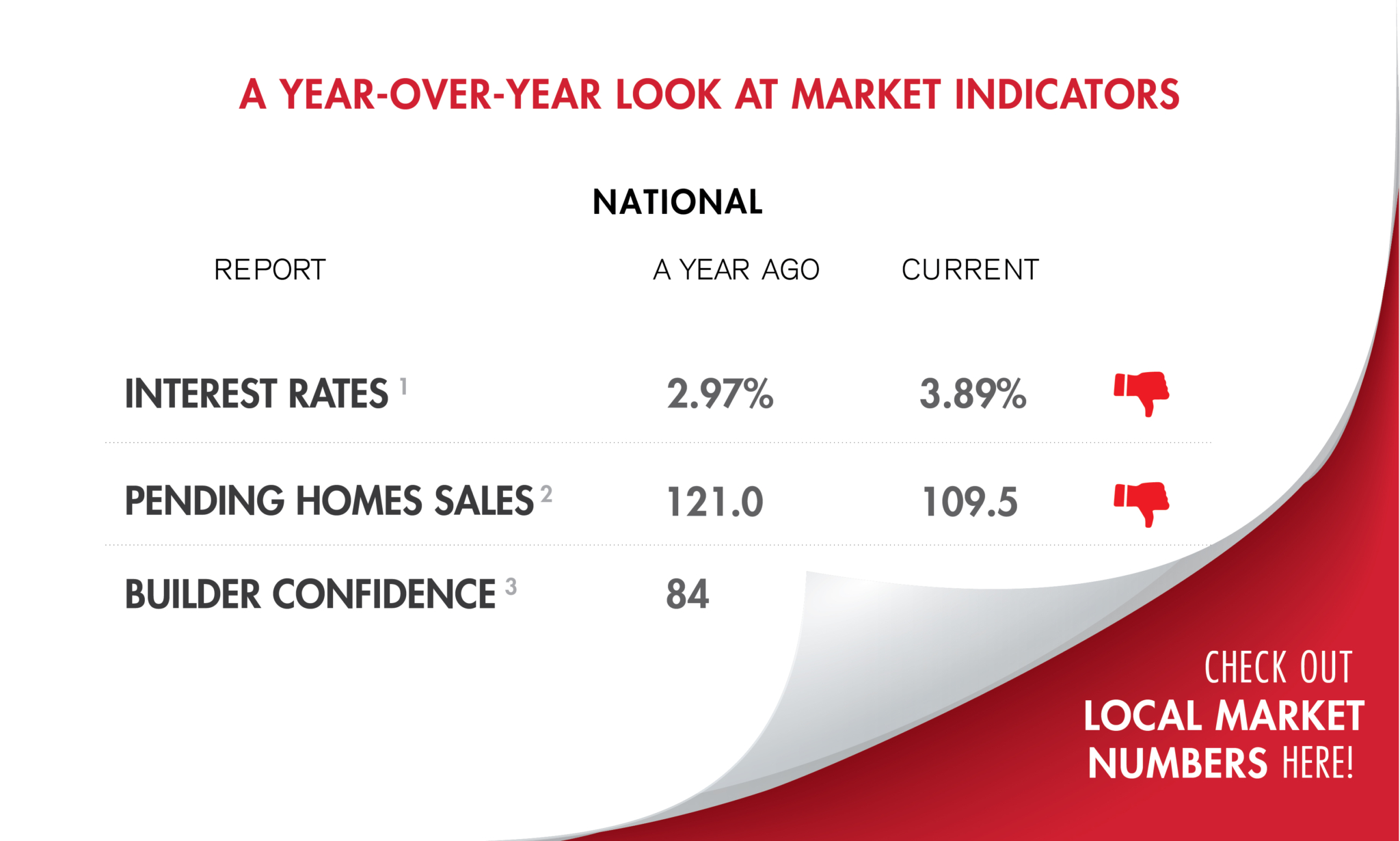

Builder sentiment has taken a hit from an unexpectedly sharp increase in mortgage rates and continued disruptions in the supply chain, according to the National Association of Home Builders’ monthly survey.

Investor activity showed early signs of slowing during Q4 of 2021, down from the historic highs seen in the second and third quarter, CoreLogic’s latest analysis reveals.

Our expectations and desires have shifted, with renters searching for more space — often at a higher price tag. And, according to a new study from RentCafe, that’s especially tough in Boston.

The decrease comes as interest rates continue to climb, according to the Mortgage Bankers Association.

“Buyer demand is still intense, but it’s as simple as ‘one cannot buy what is not for sale.” — National Association of REALTORS® chief economist Lawrence Yun

Affordability and supply-chain issues continued to weigh on the sales of new single-family residences.

What does the current generation of homebuyers and sellers look like? How old are they and how are they doing business? NAR has answers.

The median existing-home price for all housing types in February was $357,300, up 15% from a year before, as median prices rose in each region.

“More groundbreaking is welcome news for a supply-starved housing market.” — First American deputy chief economist Odeta Kushi

The measurement of six-month sales expectations among homebuilders took an especially negative turn in March, according to the National Association of Home Builders.

“Investors are weighing the impacts of rapidly increasing inflation in the U.S. and many other parts of the world against the potential for a slowdown in economic growth due to a renewed bout of supply-chain constraints.” — MBA associate vice president of economic and industry forecasting Joel Kan

Of the homes that went under contract during the four weeks ended March 6, 58% had an accepted offer within the first two weeks of going on the market, and 45% had an accepted offer within just one week, Redfin reported.

“Looking ahead, the potential for higher inflation amidst disruptions in oil and other commodity flows will likely lead to a period of volatility in rates.” — MBA associate vice president of economic and industry forecasting Joel Kan

Rents nationwide continue to grow, driven by single-family rentals, and Boston is no exception.

Housing starts, existing home sales inventory took a tumble as well in February.