Current Market Data

A 15% rise in applications for adjustable-rate mortgages drove overall mortgage applications higher in the most recent weekly survey.

New home listings are still on the rise, despite mortgage rates hitting the highest level in more than 20 years. And those high mortgage rates are pushing monthly housing payments higher than they’ve ever been.

One Massachusetts community has been named the most expensive town in the country, according to a new LendingTree report.

Regionally, pending sales were down across the board on both a monthly and an annual basis, the National Association of REALTORS® said.

Among the top upgrades: large showers.

August home sales also improved month over month.

Total housing inventory at the end of August was 1.11 million units, up 3.7% from July but down 14.6% on a year-over-year basis, the National Association of REALTORS® said.

Canceled home-sales contracts hit their highest rate in almost a year as skittish homebuyers blanche at mortgage rates that are the highest they’ve been in more than 20 years

While prices continue to break more records, sales activity showed double-digit declines

There is good news as median home and condo sale prices remain strong

Massachusetts homebuyers continue to be affected by higher prices despite modest signs of improvement, according to the Massachusetts Association of Realtors (MAR) August housing statistics report.

A rise in new listings is finally giving potential homebuyers options as the summer market winds down.

Sidelined homebuyers can breathe a sigh of relief. According to Realtor.com, the best week of the year to buy a home is still ahead of us.

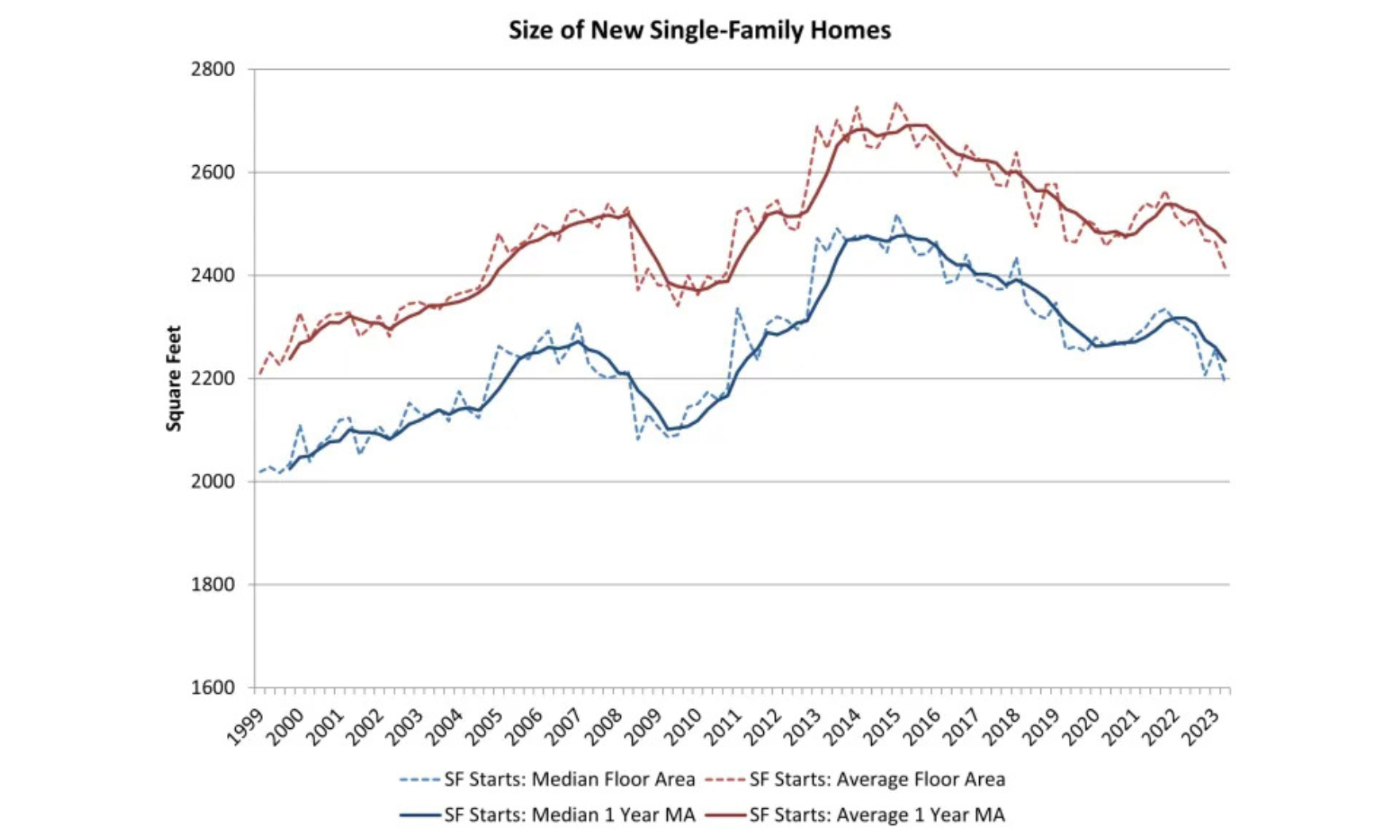

The median area for a new single-family home fell to 2,191 square feet in the second quarter — the lowest recorded size since 2010.

CoreLogic expects prices to continue to grow through next year, albeit at a more traditional pace than in the height of the pandemic.

Those looking to buy a house will be paying a premium as inventory continues to be an issue.