By the Numbers

At the same time, the average 30-year fixed-rate mortgage rose to 3.33%, its highest level since April 2021, the Mortgage Bankers Association said.

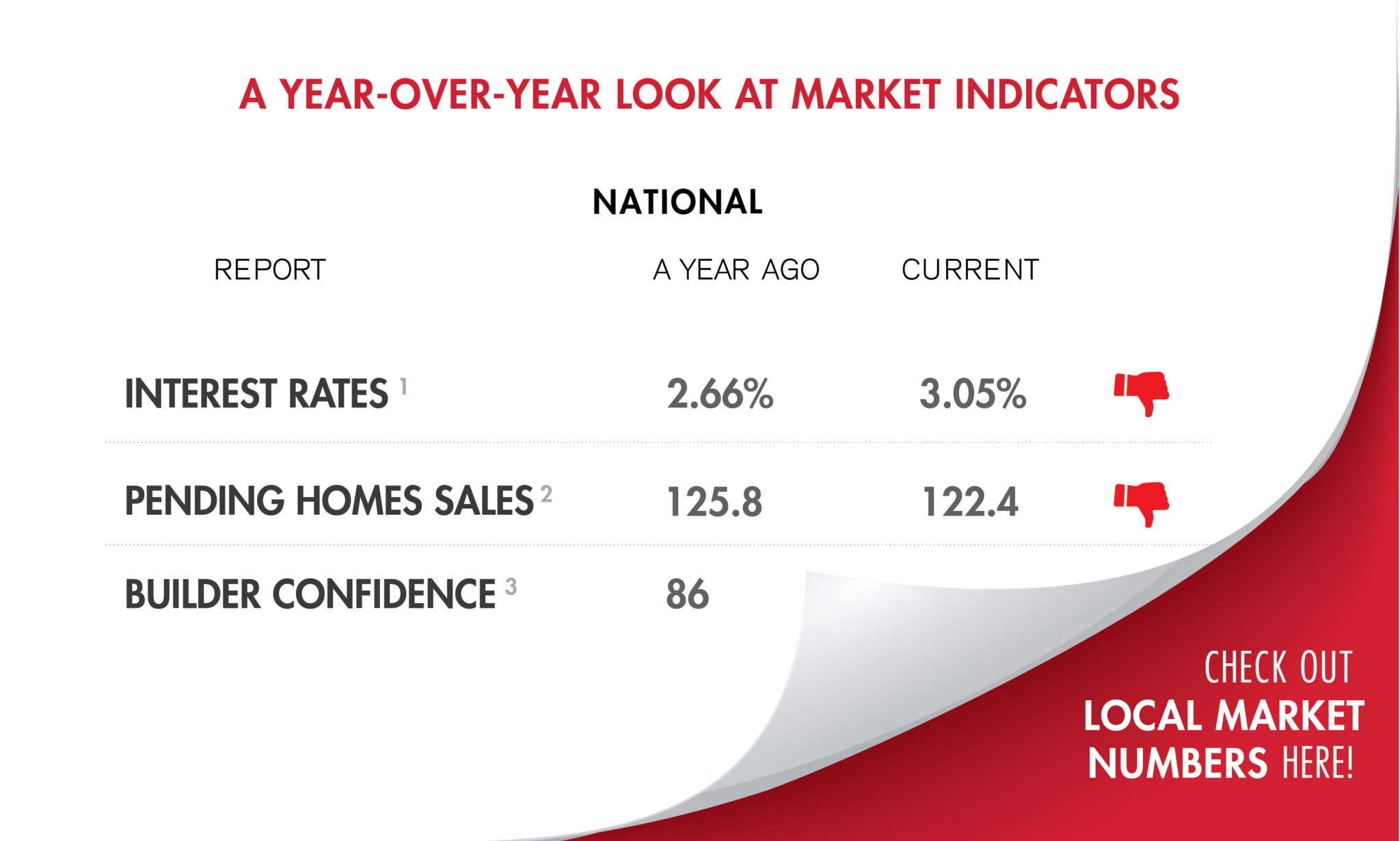

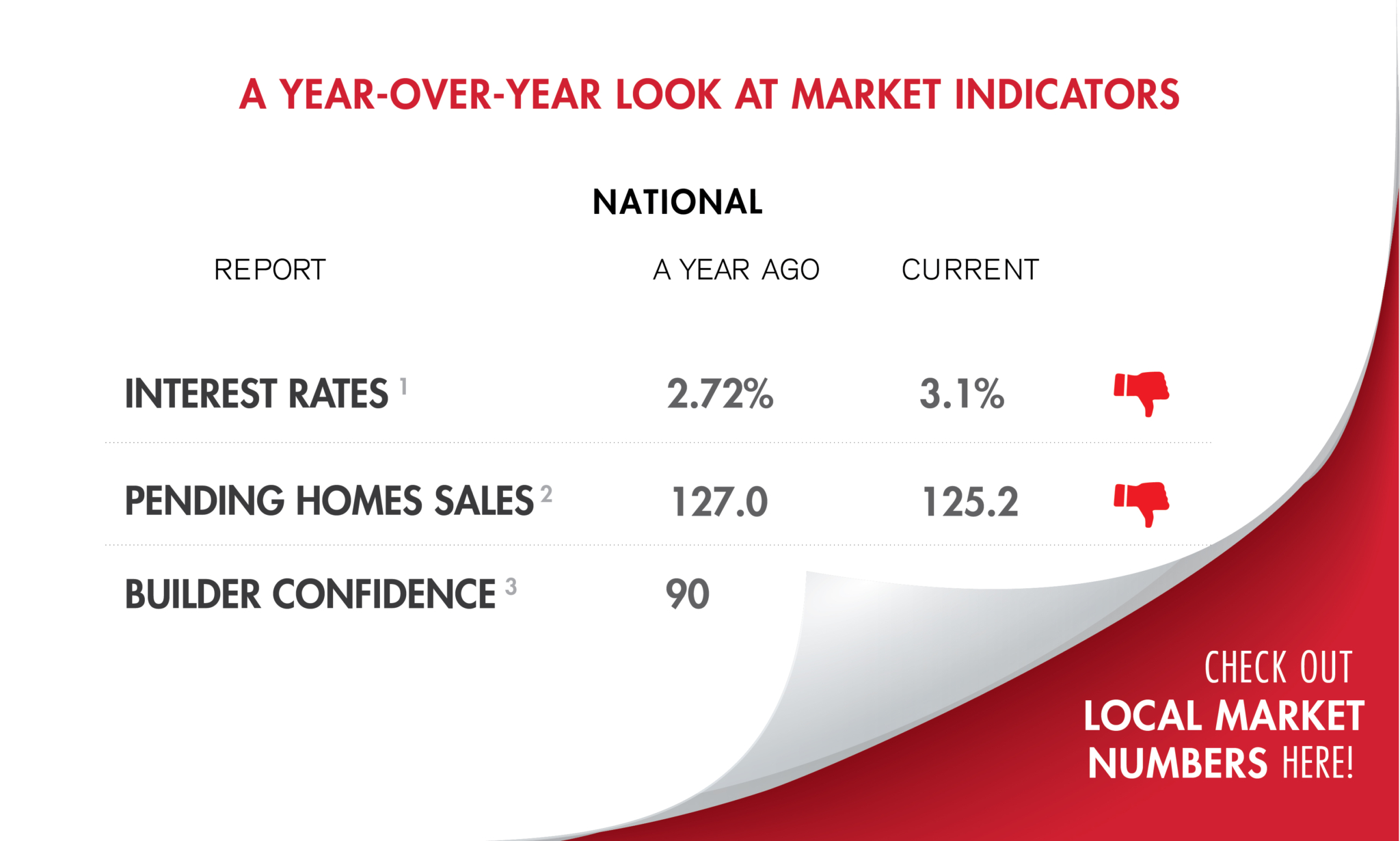

Nationally, interest rates rose as builder confidence fell.

Nationally, housing prices were also on the rise, according to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index.

“There was less pending home sales action this time around, which I would ascribe to low housing supply, but also to buyers being hesitant about home prices,” National Association of REALTORS® chief economist Lawrence Yun said.

The median sales price of new homes hit a new high of $416,900.

The median existing-home sales price for all housing types rose again on an annual basis, marking 117 consecutive months of gains.

“The market is roaring along, with only half the seasonal slowdown we typically see from October to November.” — RE/MAX LLC President Nick Bailey

The pandemic and work-from-home orders have changed where, when and why people buy homes. As a result, housing prices hit the highest median of all time in 2021, as the number of homes for sale fell to an all-time low and the demand for second homes surged, according to a new Redfin report.

“November’s housing starts report signals strength for the housing market.” — First American deputy chief economist Odeta Kushi

In unveiling its predictions, the National Association of Realtors also released its top 10 housing-market “hidden gems” for 2022.

“While 2021 single-family starts are expected to end the year 24% higher than the pre-Covid 2019 level, we expect higher interest rates in 2022 will put a damper on housing affordability.” — NAHB chief economist Robert Dietz

Millennials are at the greatest risk of becoming house-rich and cash-poor as the generation is spending the highest percentage of their monthly income on homeownership costs compared to other generations, according to a new Hometap report.

The decline in mortgage rates prompted an uptick in refinancing, with government refinances increasing more than 20% over the week, MBA associate vice president of economic and industry forecasting Joel Kan said in a press release.

At the same time, days on market fell to 26 from 31 as housing starts grew

As more money is being spent on real estate than ever before, the booming market is on pace to shatter records this year, according to a recent CoreLogic report.

The Federal Housing Finance Agency (FHFA) recently announced its 2022 conforming loan limits (CLL) for conventional loans acquired by Fannie Mae and Freddie Mac.