Current Market Data

The supply of affordable homes on the market rose a record 13% in the third quarter as mortgage forbearance programs ended, prompting low-cost homeowners to put their properties on the market.

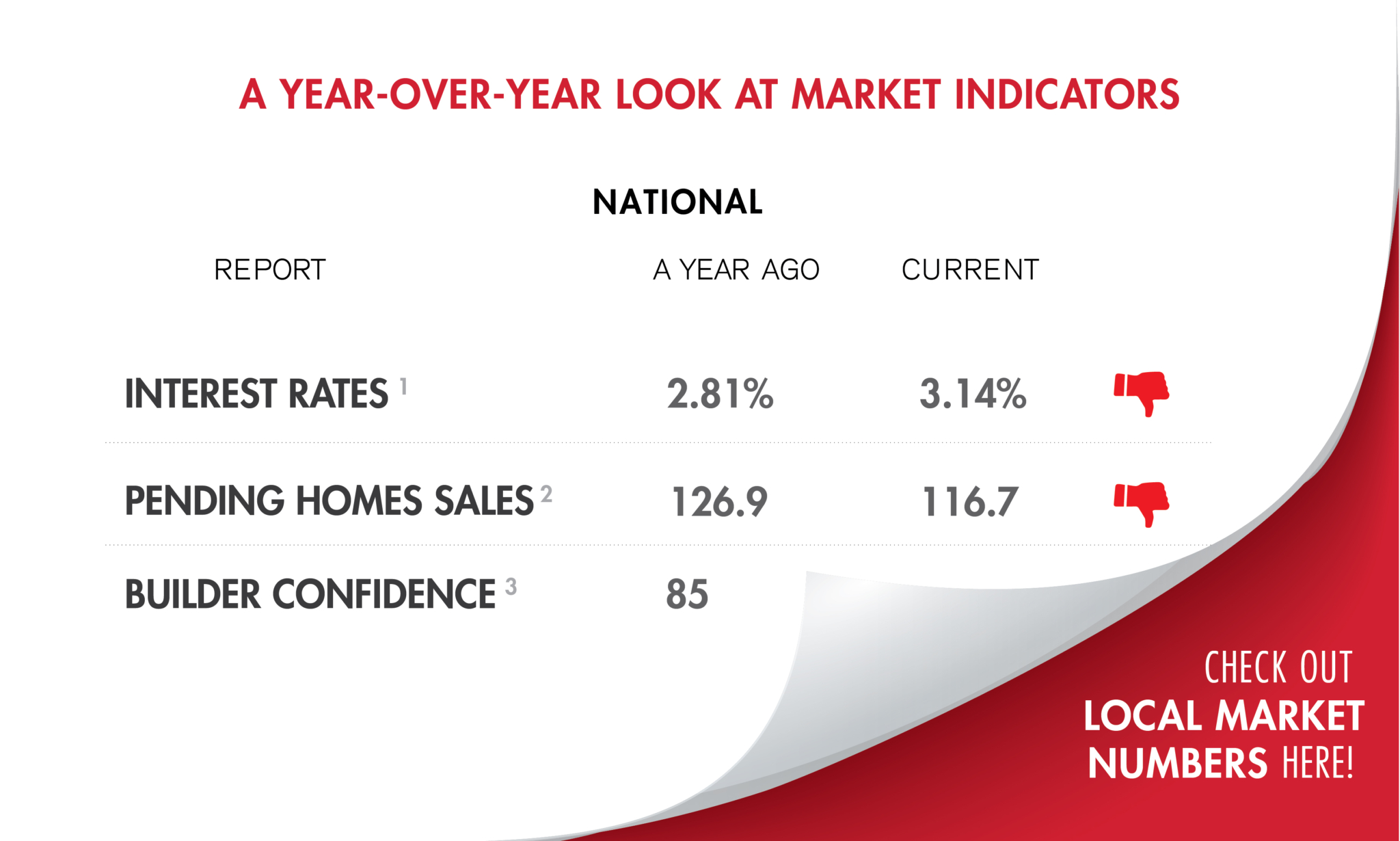

“Mortgage rates decreased for the first time since August, as concerns about supply-chain bottlenecks, waning consumer confidence, weaker economic growth and rising inflation pushed Treasury yields lower.” — MBA associate vice president of economic and industry forecasting Joel Kan

Millennials are purchasing houses — finally. Over the past year, millennials made up the largest share of homebuyers: 37% according to Barron’s.

Builder confidence was also down from a year ago.

Boston and Raleigh had the highest bidding-war rates, as the rate fell to a 2021 low.

“Contract transactions slowed a bit in September and are showing signs of a calmer home price trend, as the market is running comfortably ahead of pre-pandemic activity.” — NAR chief economist Lawrence Yun

Home-price gains were once again broadly distributed, as all 20 cities in the S&P CoreLogic Case-Shiller Home Price Index rose, although in most cases at a slower rate than a month ago.

At the same time, the increase in interest rates drove fewer borrowers to refinance their loans, according to the Mortgage Bankers Association.

“There simply aren’t enough homes for sale relative to the demand fueled by millennials armed with low mortgage rate-driven house-buying power.” — First American Deputy Chief Economist Odeta Kushi

The month also saw a slight shift in inventory, even though shortages continued.

The median existing-home price for all housing types in September was $352,800, up 13.3% on an annual basis, as every region in the country registered price increases.

September was another month for the record books in Massachusetts real estate as the median sales price for single-family homes and condos grew from last year and inventory levels continued to shrink.

Homebuyer demand remained consistent in September and despite another decrease in listings, there are indications the marketing is softening and sales prices may start to moderate.

The decrease was driven by a 5.1% month-over-month slide in the rate of multifamily starts, while single-family construction was flat.

The number of closed sales fell 12% month over month, while active inventory rose 5.6% to 7,362. Median sales prices dropped 4.8%, but that’s still up 7.3% from September 2020.

Climate change will negatively impact the already-stunted housing inventory in the U.S., according to a recent Redfin report.