Current Market Data

Millennials are at the greatest risk of becoming house-rich and cash-poor as the generation is spending the highest percentage of their monthly income on homeownership costs compared to other generations, according to a new Hometap report.

Despite those challenges, there are signs the market continues to shift toward more seasonable norms.

While the real estate market is finally showing signs of cooling after a year of skyrocketing home prices and bidding wars, desirable metros across the U.S., including in Florida, Washington and Massachusetts, can expect a big year in 2022.

According to a new survey, More than 40% of employed Americans are willing to take a pay cut or accept a new job with a lower salary to move to a more affordable location.

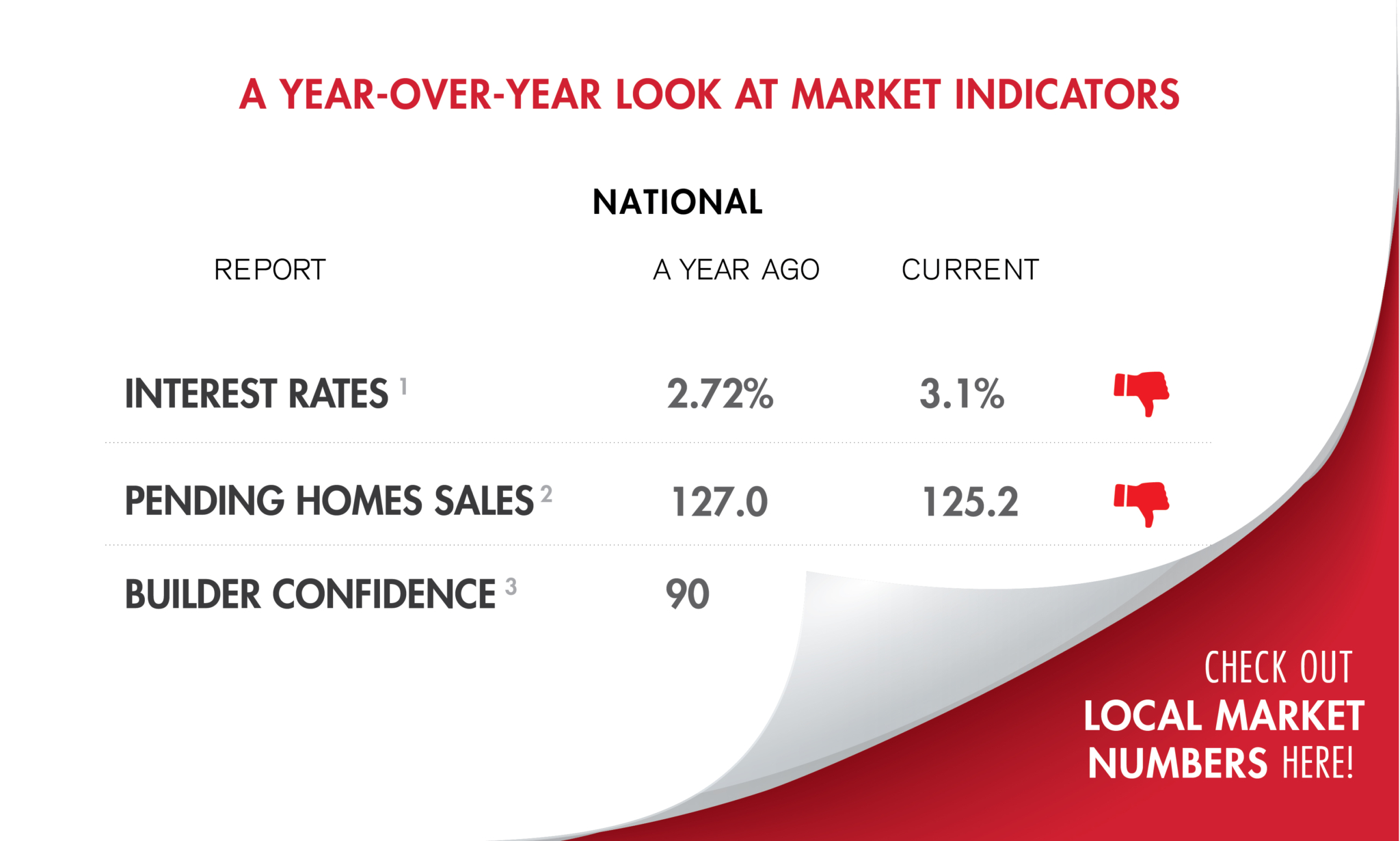

While buyer preferences for more space — both inside and outside the home — remain and supply chain issues continue to stifle home construction efforts, other factors, such as the potential increase in interest rates, are expected to change the game in 2022.

The decline in mortgage rates prompted an uptick in refinancing, with government refinances increasing more than 20% over the week, MBA associate vice president of economic and industry forecasting Joel Kan said in a press release.

At the same time, days on market fell to 26 from 31 as housing starts grew

With home prices continuing to reach new heights across the country, many potential homebuyers are seeing the mobile-home market in a brand new light as single-family home prices become less affordable for young and middle-class buyers.

As more money is being spent on real estate than ever before, the booming market is on pace to shatter records this year, according to a recent CoreLogic report.

The Federal Housing Finance Agency (FHFA) recently announced its 2022 conforming loan limits (CLL) for conventional loans acquired by Fannie Mae and Freddie Mac.

“Despite higher mortgage rates, purchase applications had a strong week, mostly driven by a 6% increase in conventional loan applications.” — MBA associate vice president of economic and industry forecasting Joel Kan

Investors across the country are looking to cash in on skyrocketing house prices and rents, putting them in competition with new buyers trying to work their way to homeownership.

The home remodeling platform Houzz has compiled their 2022 trend forecast: a list of 10 interior design predictions.

The Cape Cod housing market slowed down in October as the lack of housing inventory continued to decline.

“If I had to choose only one word to describe September 2021’s housing price data, the word would be ‘deceleration. Housing prices continued to show remarkable strength in September, though the pace of price increases declined slightly.” — S&P DJI managing director Craig Lazzara.

Inventory constraints are pushing some potential buyers to rent, increasing competition and rent prices.