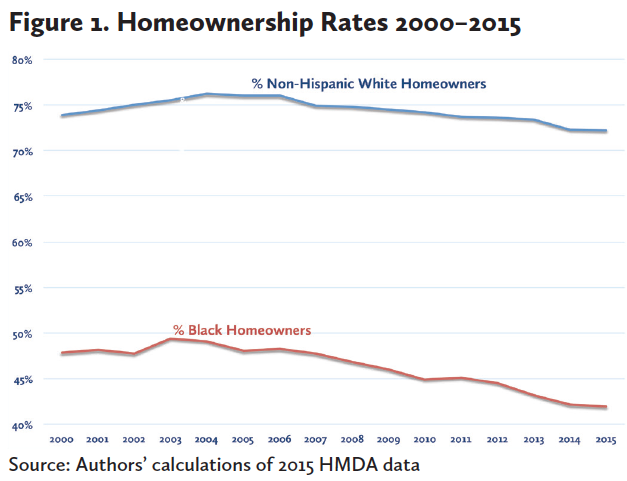

Black homeowners were hardest hit by the 2007 recession and have not been able to recover as quickly as most other homeowners. However, according to a new report from the National Association of Real Estate Brokers (NAREB), black homeownership is back on the rise.

The 2017 State of Housing in Black America (SHIBA) report found that black homeownership rose from a near 50-year low of 41.3 percent in the third quarter of 2016 to higher than 42 percent in the first two quarters of 2017.

However, this is still below the 2004 peak of 49.1 percent and significantly below the homeownership rate for non-Hispanic whites of 72 percent.

“While economic recovery is still out of reach for far too many black Americans, NAREB sees a break in the storm. Black consumers are slowly regaining confidence in the marketplace, but institutional obstacles remain,” said Jeffrey Hicks, president of NAREB.

In order to make homeownership more attainable, the report indicates that federal policy changes need to be made to combat unequal access to credit, unfair fees and cost equivalences for mortgage products, and enhance mortgage loan disposition.

“Given the fact that nearly 30 percent of denials for loans to blacks are due to credit history, the delay in making changes to government-sponsored enterprises’ (GSEs) credit-scoring policy until 2019, is unnecessary and unfair,” the report states.

Instead, the report highlights the use of trended data to offset the current credit-scoring practices, looking to provide a better understanding of a consumer’s credit behavior with up to two years of credit history.

“In spite of the fact that both FICO and VantageScore have scoring tools that are more predictive than the models currently required by all three major federal mortgage agencies, Federal Housing Finance Agency Director Mel Watt has announced that no action on credit score modernization will occur before 2019,” SHIBA reports.