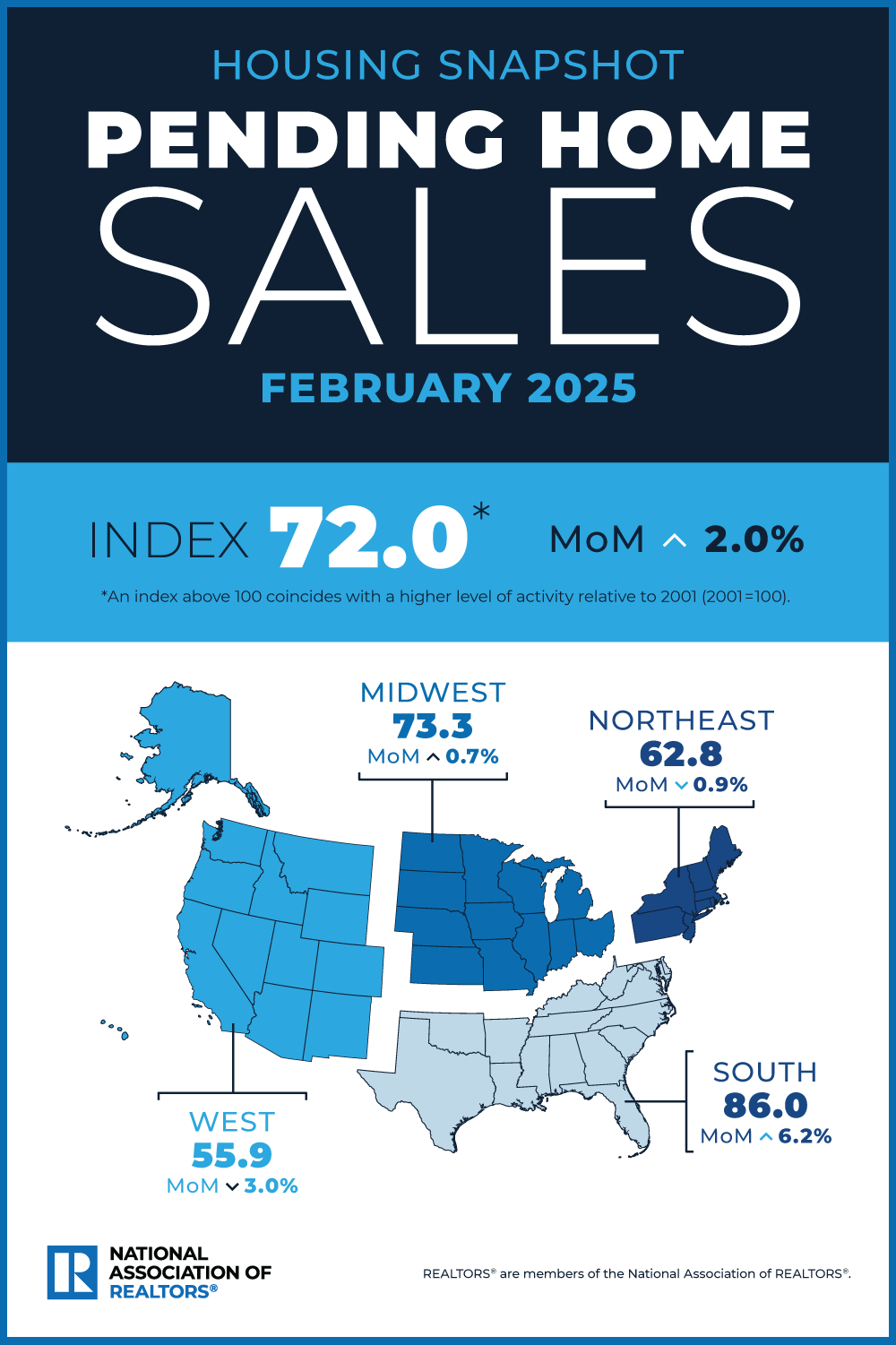

Pending home sales topped expectations in February but remained “well below” historical levels, the National Association of REALTORS® (NAR) said, citing its Pending Home Sales Index.

Pending home sales topped expectations in February but remained “well below” historical levels, the National Association of REALTORS® (NAR) said, citing its Pending Home Sales Index.

The index rose 2% month over month in February, compared to economists’ consensus estimate of a smaller 0.9% gain. Year over year, the index was down 3.6%.

“Despite the modest monthly increase, contract signings remain well below normal historical levels,” NAR Chief Economist Lawrence Yun said. “A meaningful decline in mortgage rates would help both demand and supply — demand by boosting affordability, and supply by lessening the power of the mortgage rate lock-in effect.”

NAR expects mortgage rates to average 6.5% in 2025 and 6.1% in 2026. Existing-home sales are expected to rise 6% this year and jump another 11% next year.

“Considering the Federal Reserve’s recent forecast for slower economic growth, we expect mortgage rates to slide moderately lower,” said Yun. “But the current high national debt will prevent mortgage rates from falling drastically — and certainly not to the 4%-to-5% range seen during President Trump’s first term.”

Pending sales, in which the contract has been signed but the transaction has not closed, are considered a leading indicator and generally precede existing-home sales by a month or two.

“While pending home sales exceeded expectations in February, they are hovering near historical lows, signaling a slow start to the busy spring homebuying season,” First American Senior Economist Sam Williamson said. “Purchase mortgage applications — another leading indicator of housing activity — rebounded slightly in March but also remain well below historical levels.”