The self-storage industry is growing — according to StorageCafe, close to 53 million square feet of new self-storage space will join the U.S. landscape in 2023. But what does that tell us about the current state of renters’ — and homeowners’ — need for extra space?

Over one-fifth of all Americans currently rent storage units. StorageCafe lists work flexibility, including the increase in work-from-home or coworking arrangements, increases in RV travel and the rise in home-run small businesses as just a handful of the reasons storage spaces have increased in popularity since the pandemic.

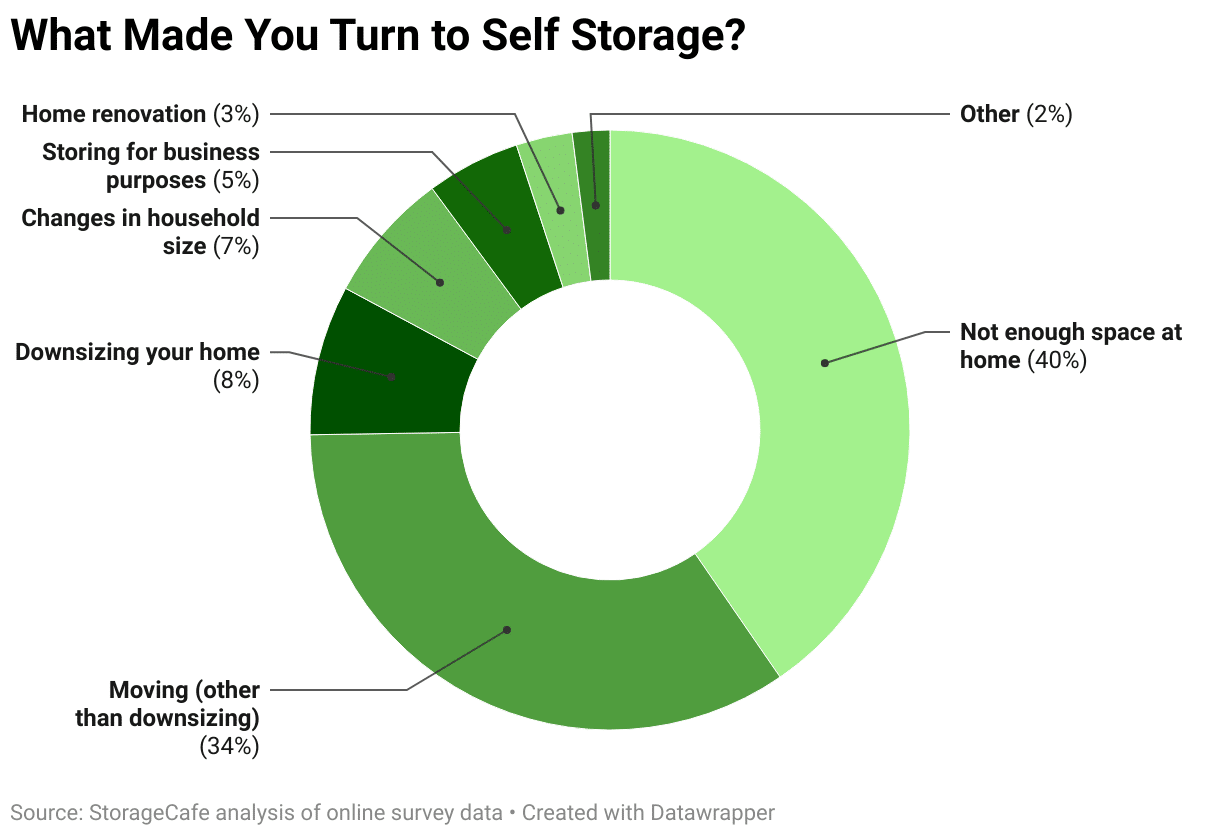

via StorageCafe

Gen X — or, those currently aged 40 to 55 — make up the majority of self-storage renters. In fact, nearly a quarter of all Gen X adults do so. People in this age group are most likely to cite not having enough space at home as the main reason for renting storage space.

In fact, the need for more space is common among all self-storage users: 40% of survey respondents listed this as their primary reason for renting storage space (up from 33% in last year’s survey). The next highest share of self-storage users said moving was their main reason.

Renters are more likely to rent self-storage during a move than homeowners, at 44% compared to 25%. Similarly, the survey found that self-storage rental is much more likely for people living in spaces between 1,000 and 1,499 square feet.

Self-storage usage also increases with household size: Approximately 18% of storage space users live in households with one to three people. For four-person households, self-storage usage increases to 21%, and for households with five or more people, it jumps to 27%.

“The storage market enjoys considerable momentum,” said Doug Ressler, business intelligence manager for Yardi Matrix. “The new trend in multifamily development that sees apartment sizes shrinking nationally, plus the shifting patterns in migration, result in changing priorities about living arrangements, especially in places seeing a high inbound-population flow.”

Self-storage is on the biggest rise in the Southwest: while interest in storage space (measured by internet searches) has nearly doubled across the country from 2019 to present, the biggest increases have been in Dallas (+273%), Houston (+218%) and Phoenix (+236%).