In September, distressed sales accounted for 9.7 percent of total home sales nationwide; the culmination of declines that span the past few years, according to CoreLogic.

Considering the current pace of distressed sale declines, CoreLogic researchers determined that the market could see a return to the “normal” 2-percent share of distressed sales by mid-2018.

In many markets around the country, foreclosure rates, which are direct reflections of local distress, have already dwindled to levels more common during the years preceding the economic downturn. However, not every market has made such progress.

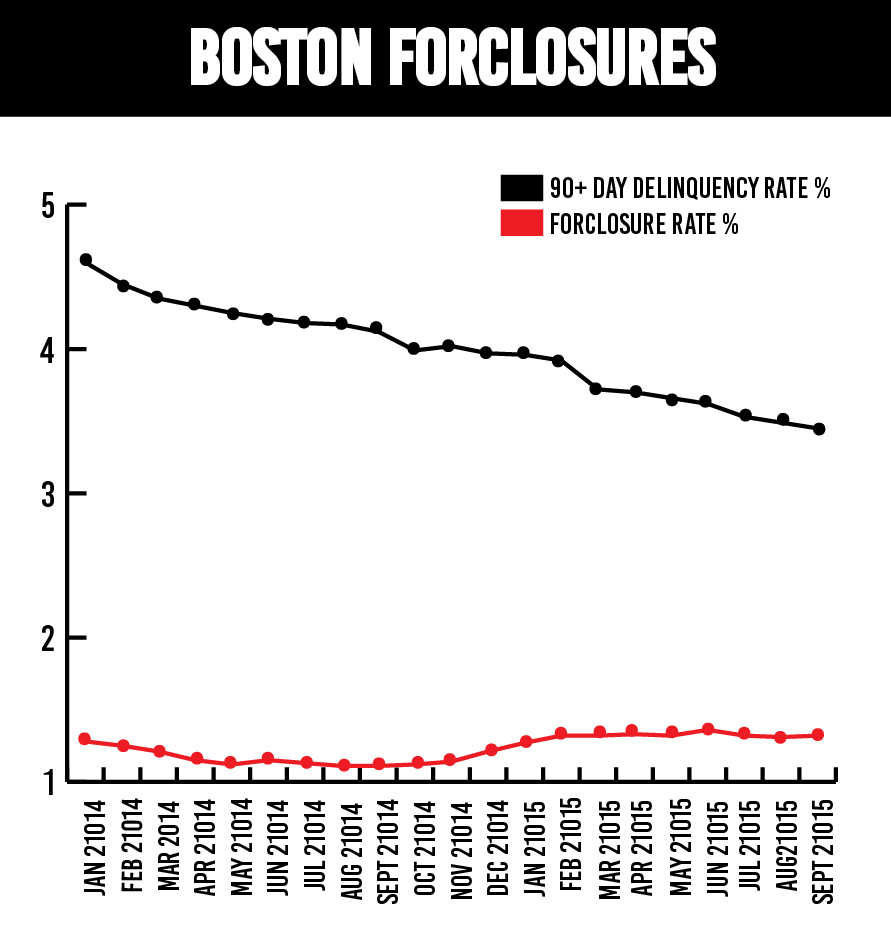

In both Massachusetts and its biggest metro and capital, Boston, foreclosure rates have remained relatively low since Jan. 2014. But since mid-2014, the rates have been inching forward. Statewide, foreclosures climbed from 1.16 percent in Sept. 2014 to 1.42 percent in Sept. 2015, while Boston’s rate has risen from 1.11 percent to 1.32 percent.

The recent rise has some concerned, but most in the area attribute the small growth to a backlog of foreclosures that are only now being processed – and falling serious delinquency rates seem to support that.

Serious delinquencies in the state dropped nearly a percentage point year-over-year to 3.61 percent in September, while delinquencies in Boston fell from 4.12 percent to 3.45 percent.