via NAHREP

The rate of Hispanic homeownership is steadily increasing, new data from The National Association of Hispanic Real Estate Professionals (NAHREP) shows. With 8.8 million Hispanic-owned households, more than 48% of Latinos now own homes, reflecting a continual rise since 2014.

NAHREP’s 2021 State of Hispanic Ownership report, available now, considers the statistics from the previous year to present an updated look at the demographic’s homeownership trends. It also includes the annual Latino Buyer Survey and, for the first time, qualitative interviews with top-producing Latino real estate agents. The various sources paint a complex, but fairly positive, picture.

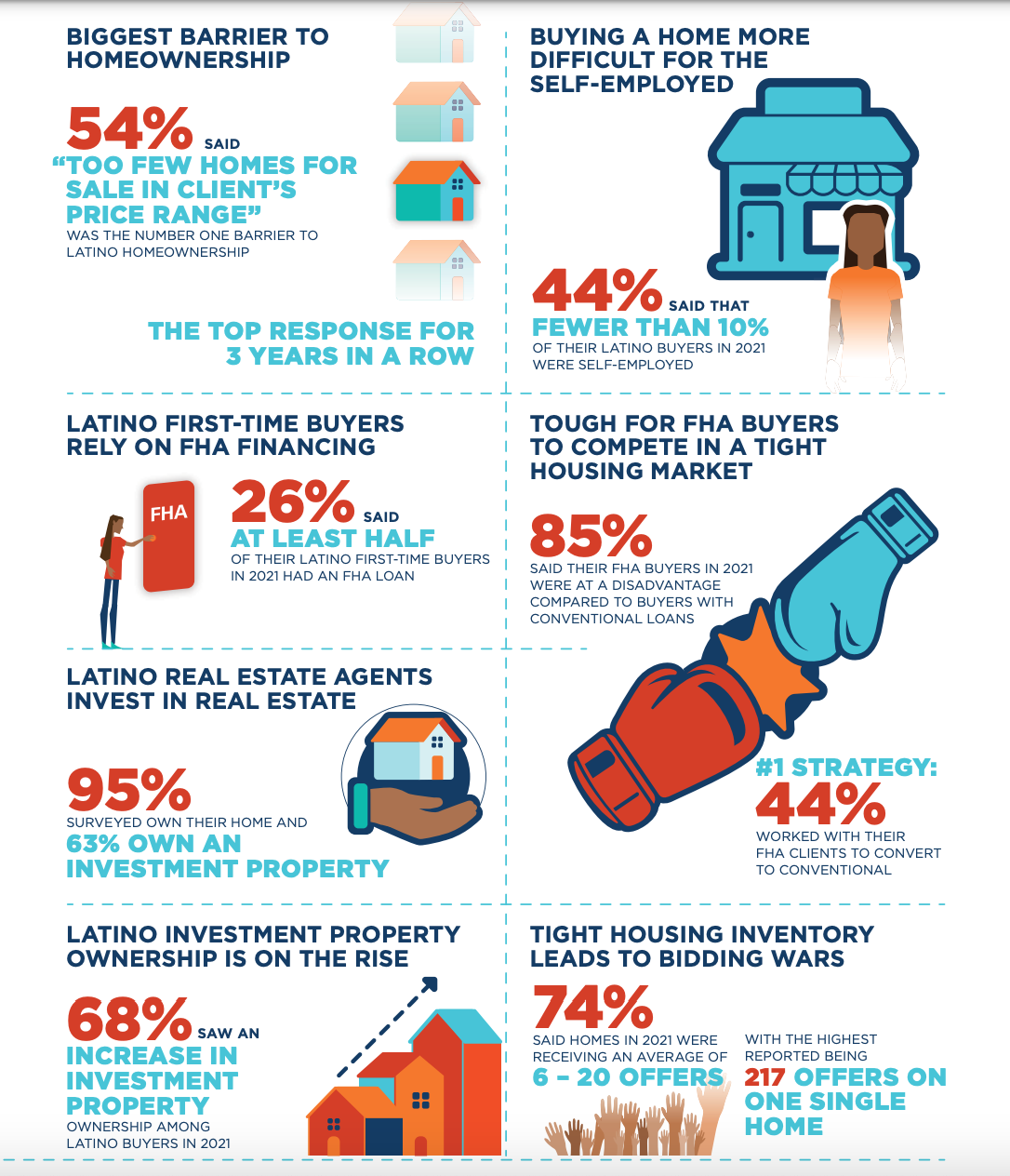

Although Hispanic ownership did increase in 2021, the particularly hostile conditions of the 2021 market were felt by many Latino buyers — especially those first-time buyers relying on low down payment loan products. Latinos are twice as likely to use Federal Housing Administration (FHA) to finance their homes, as opposed to white buyers, yet are 81% more likely to be denied. In turn, the proportional share of new Latino homeowners shrank to just 18.1% during 2021, down significantly from 2015’s historic high of 68%.

“Every single one of these new homeowners in the data had to go through a lot of hoops just to get to the finish line and get their keys,” said Nora Aguirre of the Nora Aguirre Team with Century 21 Americana.

Naturally, the year’s low inventory and rising prices were also significant factors. Due to high pricing, many first-time buyers purchased outside of the more typically Latino markets, opting instead for more affordable homes in the Midwest and the South.

In NAHREP’s agent interviews, too, the affordability issue emerged as a primary concern. “With the clients I was working with on the Hispanic side, it was challenging across the board,” said Anthony Gibson of Austin Properties Group with Keller Williams. “The entry price point was moving so quickly and demand was pushing the prices so much over the list price where it was all about who had more cash.”

And yet, Latinos buy homes at a younger age than most Americans. In 2021 alone, 34% of recent Latino homeowners were between the ages of 18 and 24, as opposed to just 17% of the general population. As a fast-growing demographic (Latinos have accounted for 51% of the national population growth in the last decade) with a median age of 30, the majority of Latinos are now in their prime homebuying years.

These millennials are also increasingly mortgage ready. “My Latino clients are young and they are more prepared than in the past,” said Neily Soto of Century 21 North East. “The younger generations have already dealt with credit for school so they are more ready for a mortgage than ever before.” In 2021, 8.3 million Latinos were mortgage-ready, twice the number from 2015.

And though FHA discrimination remains a core issue, looking ahead, it’s predicted that 70% of homeownership growth will come from Latino households over the next 20 years.

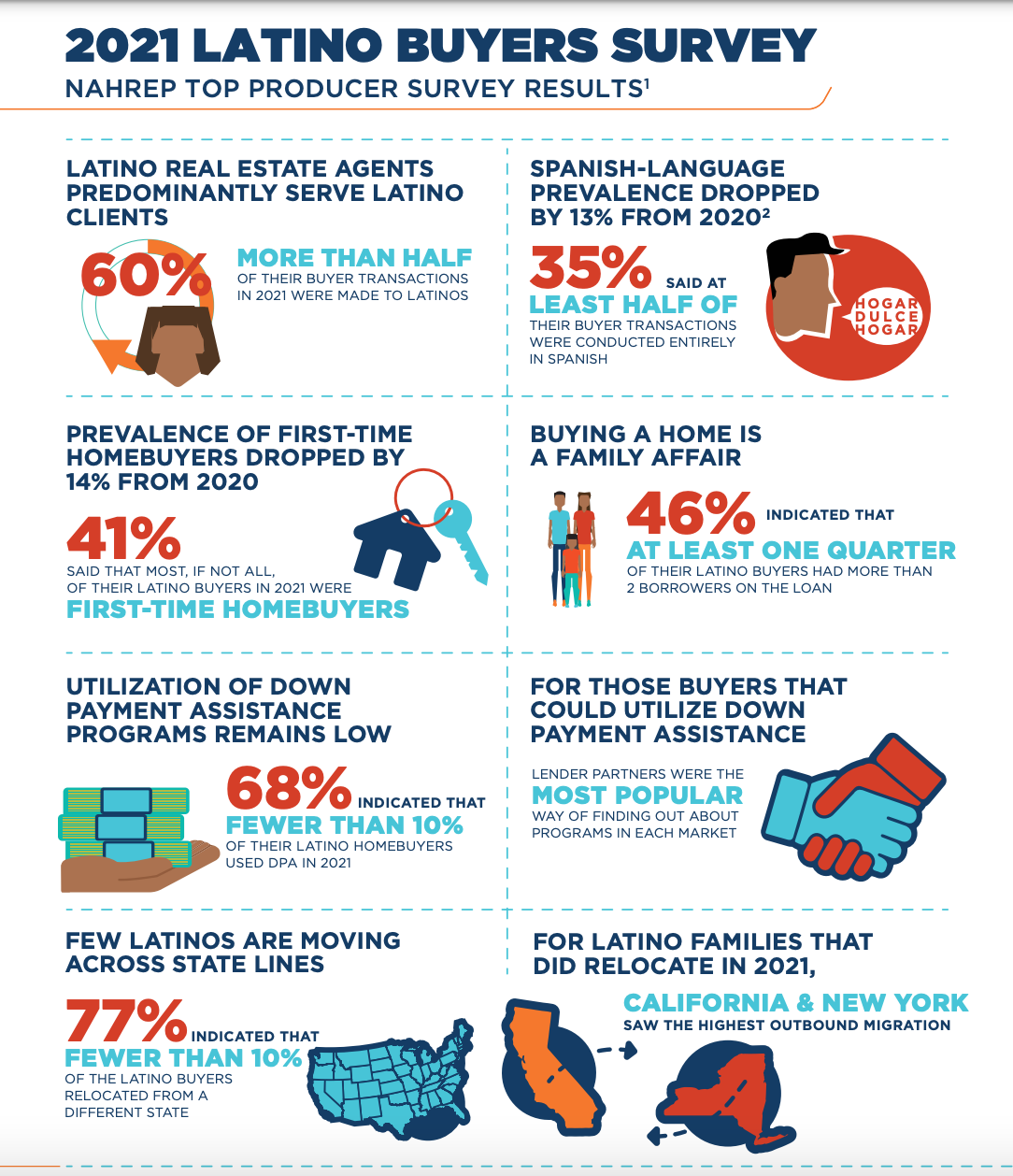

NAHREP’s annual Latino Buyers Survey*

* NAHREP surveyed 620 top producing Latino real estate agents in 39 states plus Puerto Rico. Survey respondents answered questions based on their

Latino purchase/buyer transactions that took place in 2021. Survey was administered online between February 10-28, 2022.