Mortgage delinquencies fell nationally to pre-pandemic levels in November and serious delinquencies dropped, according to the latest Loan Performance Insights report from CoreLogic. But cities like Boston continue to see higher delinquency numbers than in 2019.

“The consistent decline in serious delinquency since August is a sign of growing financial stability for families,” said Frank Martell, president and CEO of CoreLogic. “In addition to ensuring that homeowners stay in their homes, the decline in delinquency means fewer distressed sales, which is both a positive for individual households and the overall housing market.”

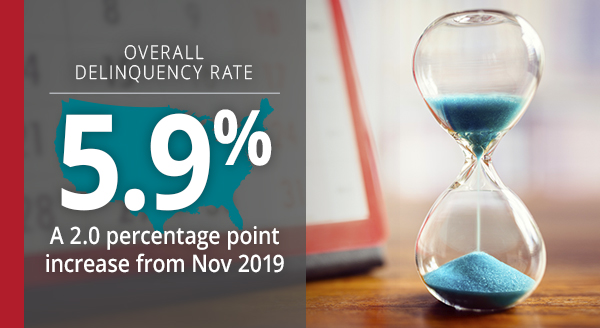

Nationally, 5.9% of all mortgages were at least 30 days delinquent in November. That figure represents a 2% year-over-year increase from November 2019, when the overall delinquency rate was 3.9%. The delinquency rate has fallen since spiking in April 2020.

Early-stage delinquencies that were 30-59 days past due were at 1.4%, down from 2% in November 2019. Delinquencies 60 to 89 days past due remained unchanged at 0.6%. Serious delinquencies 90 days or more past due, as well as loans in foreclosure, were at 3.9%. That figure is an increase over the 1.3% rate in November 2019 but also represents the lowest serious delinquency rate since June 2020. The foreclosure inventory rate dipped from 0.4% in November 2019 to 0.3% in 2020, while the share of mortgages transitioning from current to 30 days past due fell from 1% to 0.8%.

Every state registered a year-over-year delinquency increase in November, and nearly every major U.S. city saw delinquencies rise. While unemployment numbers fell from 14.8% in April to 6.7% by the end of the year, the hospitality and oil industries continue to struggle. Hawaii and Nevada gained the largest increases in delinquency rates at 4.3 percentage points and 4.2 percentage points, respectively. Odessa, Texas logged the largest delinquency increase at 9.5 percentage points, followed by Lake Charles, Louisiana (up 9.1 percentage points); Midland, Texas (up 7.4 percentage points); and Kahului, Hawaii (up 7.2 percentage points).

“Urban areas hit hard by the pandemic recession or by a natural disaster experienced the largest spike in delinquency over the last year,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Forbearance and loan modification helped struggling families rebuild their financial house in hard-hit places. While vaccination will mitigate the pandemic, the best cure for delinquency is income restoration through job creation.”

Mortgage delinquencies fell nationally to pre-pandemic levels in November and serious delinquencies dropped, according to the latest Loan Performance Insights report from CoreLogic. Meanwhile, Boston and other cities continue to see higher delinquency numbers than in 2019.

In the Boston-Cambridge-Newton MA-NH metropolitan area, 4.6% of all mortgages were at least 30 days delinquent, up from 3.1% in November 2019. The serious delinquency rate was 2.9%, a year-over-year increase from 0.9%, while the foreclosure rate was 0.2%, down from 0.3% the previous November.