As the number of coronavirus cases in the U.S. ramp up, with cases in New York and California doubling every few days, hospitals increasingly overwhelmed and the U.S. economy at a standstill due to the widespread shutdown of businesses, Meyers Research Chief Economist Ali Wolf opened her weekly COVID-19 housing market webinar yesterday with some sobering labor data.

According to statistics from the Department of Labor, more than 3 million Americans filed for initial jobless claims last week. “Unemployment levels have gone from 3.5 to 5% in one week,” Wolf says. “To put it into perspective, during the Great Recession, we were at 10%. Right now, we’re expecting unemployment rates to hit 20 or 30%.”

Buckle your seatbelts, because we’re in for a rough ride.

While an estimated 500,000 new jobs (CVS, Amazon, Domino’s) will provide a stop gap for some Americans, the majority of those jobs are minimum wage. And jobs, said Wolf, are the biggest driver of housing stock.

According to Wolf, 70% of builders saw on-site traffic decrease by 20% week over week and so far, 40% of builders have seen a negative impact on the availability of government services due to limited staff. While Wolf doesn’t expect prices to come down just yet (maybe not at all), she did say more than 26% of builders have increased incentives week over week. To date, builders haven’t experienced supply shortages, but that will change. “Somewhere along the line, there will be a disruption in supply,” Wolf said.

Speaking of supply, we went into this recession with record low housing inventory, and that situation is expected to worsen. “We do think we’ll see fewer people putting their homes on market,” Wolf said. “There will be less inventory available.” The upside of low inventory is price stabilization, said Wolfe, adding that 97% of prices have held up because inventory is so low.

During last week’s webinar, Wolf presented two different scenarios for how the recession is going to play out. Yesterday, she reviewed and revised both scenarios.

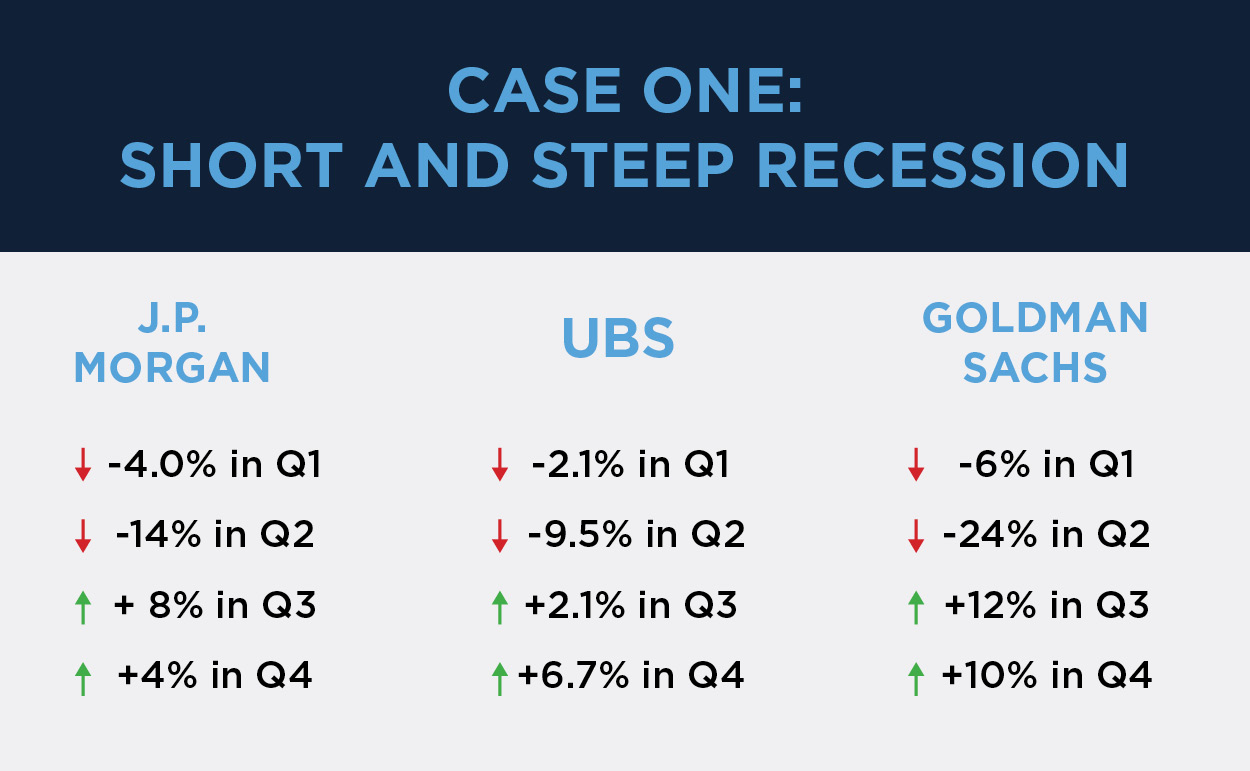

Case 1 involves a short recession with a sharp and steep drop in Q2, with a V-shaped recovery by Q4. It is currently the prevailing theory, with Goldman Sachs, UBS and J.P. Morgan all predicting steep drops of anywhere between 9.5% to 24% in Q2.

In an interview yesterday, St. Louis Federal Reserve President James Bullard predicted an even steeper Q2 drop by as much as 50%.

“It’s a planned partial shutdown of the U.S. economy, mostly during the second quarter,” Bullard said during an interview on the CNBC show “Squawk Box.” “It’s an investment in public health. It’s not a recession as conventionally defined because this is an intentional move being made here.”

“These numbers will be unparalleled, but don’t get discouraged,” Bullard added. “This is a special quarter, and once the virus goes away and if we play our cards right and keep everything intact, then everyone will go back to work and everything will be fine.”

Case 2, which no one wants, and fewer are predicting, is long recession with a 16% drop in Q2 and no rebound in subsequent quarters. But according to Wolf, that’s what we will be facing if we’re not able to enact extreme containment measures and make testing kits – including a rapid 45-minute test that was just FDA-approved – widely available.

There is also some hope that warmer weather will slow the growth of the virus, not to mention the possibility that a medication will be found to be effective.

But if what’s happened in China is any indication, the pain will be short-lived. An estimated 85% of activity outside of Hubei Provence has returned, 80% of China’s shopping centers have been re-opened, 81% of manufacturing companies have resumed business and e-commerce has gone from a near shutdown to almost 100% recovery in four weeks.

Noting that the number of COVID-10 cases are going to spike, leading to nervousness about April contracts, fears about cancellations and a focus on preserving cash, Wolf predicted that the strong housing market we had in place before the coronavirus recession will ultimately help us recover.

“We entered into this with more demand than we ever could have imagined,” she said. “Housing will lead us out of this recession.”