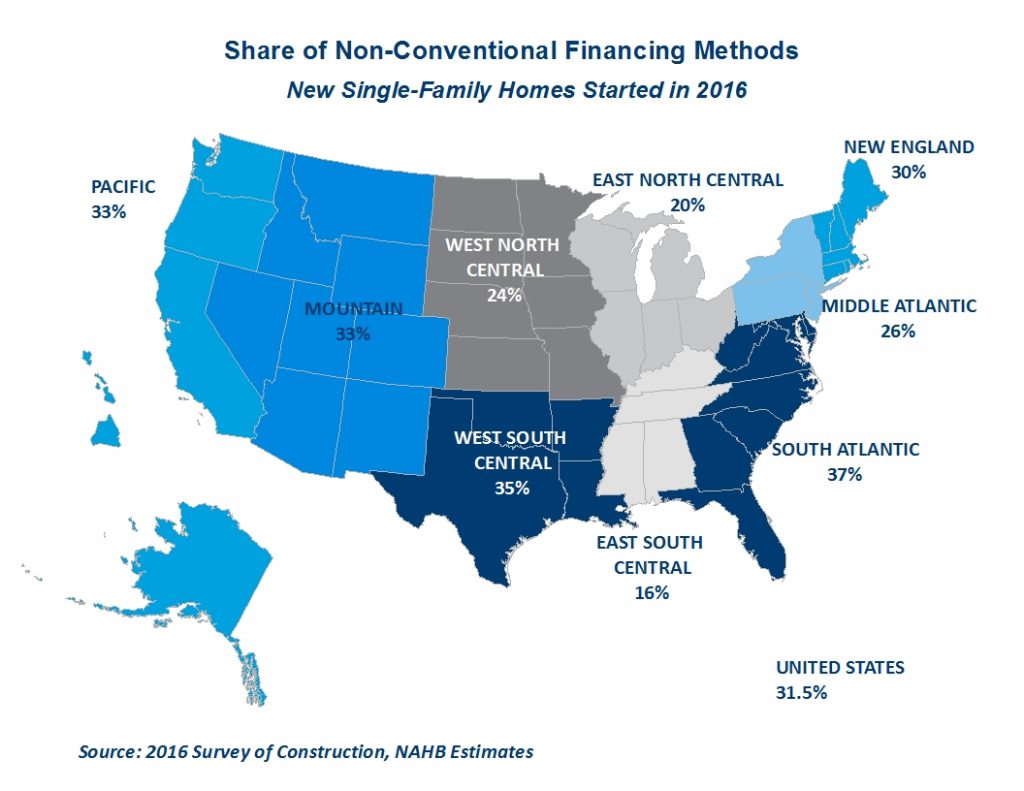

Nationwide, non-conventional forms of financing accounted for less than a third of the new single-family home market for the first time since 2008, according to the National Association of Home Builders’ analysis of the 2016 Census Bureau Survey of Construction data.

Non-conventional financing includes FHA loans, VA-backed loans, cash purchases and other financing options from organizations such as the Rural Housing Service and Habitat for Humanity, loans from individuals, and state or local government mortgage-backed bonds.

Non-conventional financing declined nationally in 2016 to 31.5 percent. The South Atlantic region topped the list with non-conventional financing accounting for 37 percent new single-family home starts — 19 percent of those made up of FHA-backed loans, the largest share in the country.

The West South Central, Mountain and Pacific divisions also relied heavily on non-conventional financing, exceeding the national average.

Source: National Association of Homebuilders

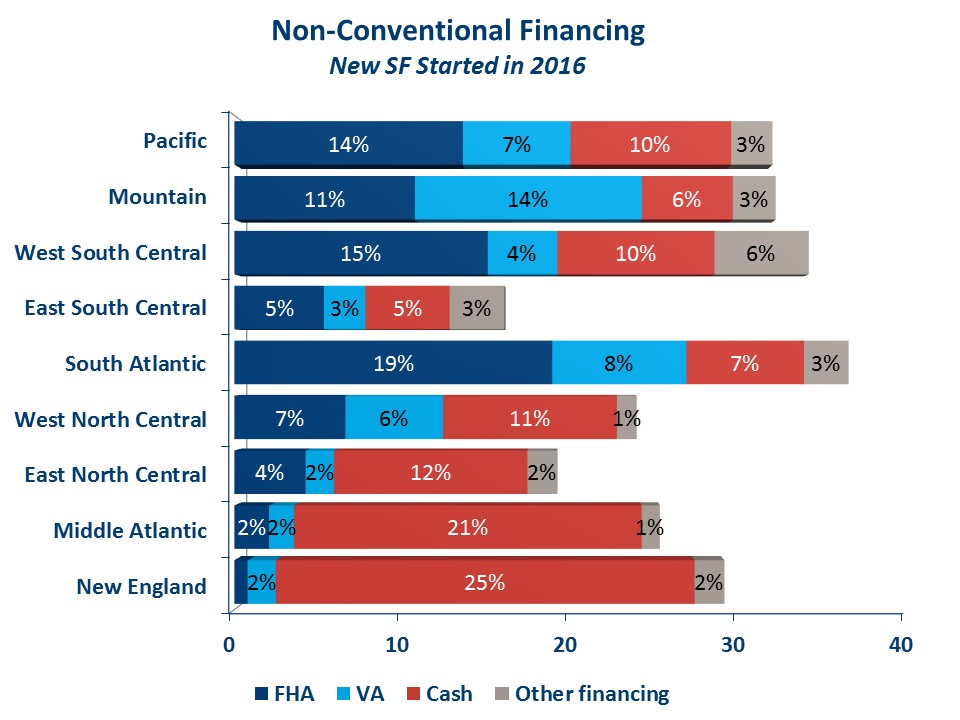

Of the 35 percent of loans that came from non-conventional options in the West South Central region, 15 percent were FHA-backed loans and 10 percent were cash purchases. The Pacific region also relied heavily on FHA-backed loans, making up 14 percent of all non-conventional loan choices, followed by 10 percent in cash purchases. In the Mountain region, 14 percent relied VA-backed loans, followed by 11 percent utilizing FHA loans.

In 2016, the share of mortgages insured by the FHA was 13 percent, while VA-backed loans made up 7 percent of the market. Cash purchases declined in 2016 to 9 percent.

However, cash purchases made up a quarter of all New England non-conventional financing options and 21 percent in the Middle Atlantic region. NAHB believes the high number of cash financing in these areas is due to the popularity of custom homebuilding as these regions were the top markets for custom home shares. In 2016, a third of custom homes built by owner were financed with cash.