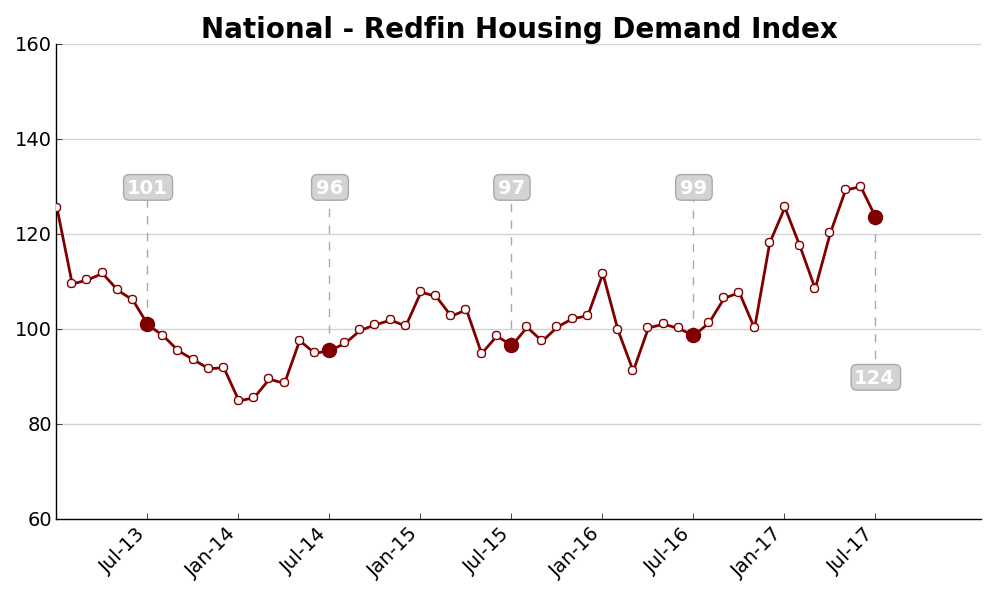

Redfin’s Housing Demand Index dropped 5 percent in July from June’s all-time high, but is still up almost 30 percent from last year.

The index, which currently sits at 124, is based on Redfin customers’ home tour requests and writing offers. The historical average for the period from January 2013 to December 2015 is 100.

July was the 26th consecutive month of year-over-year inventory declines, with a 5.9 percent drop in new listings compared to last year. This is one of the major factors affecting the drop in the Demand Index from June. The number of buyers requesting home tours fell 3.3 percent from June and the number of written offers dropped 11 percent.

However, on a year-over-year basis, more buyers are requesting tours and writing offers, with increases of 35.3 percent and 21 percent, respectively.

“Buyer demand has been stronger so far in 2017 than last year, but the combination of low inventory and rising home prices is taking its toll heading into the fall,” said Nela Richardson, Redfin chief economist. “Sellers are still in control of the market, but their advantage is narrowing as buyers are becoming less willing or able to chase escalating prices.”

Historically the real estate market has gone thru price cycles up and down. Late 80’s , early 90’s, 2005. The time is creeping closer for a correction. All and all real estate in the long run is a win situation. That’s just my opinion after 37 years of full time real estate sales experience.