National distressed sales – including real-estate owned (REO) and short sales – fell 1.9 percentage points in November 2015, pushing the distressed share of total sales to its lowest November point since 2007, according to a new report from CoreLogic.

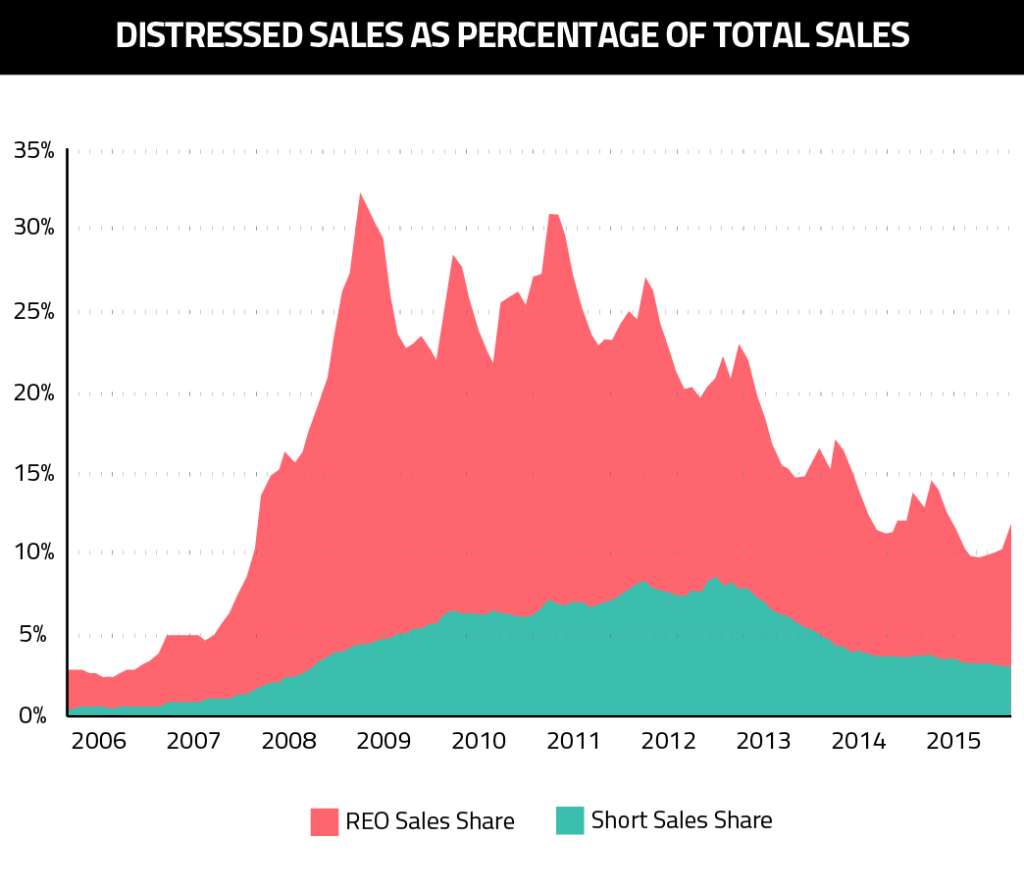

Nearing the end of 2015, distressed sales accounted for 11.9 percent of total home sales nationally. The trend of falling REO and short sales (on a year-over-year basis) has been consistent since 2011, as the below graph illustrates.

The makeup of distressed sales is roughly three parts REO sales and one part short sales.

In November, 8.7 percent of total home sales came from REO transactions, which represents a year-over-year drop of 1.5 percentage points and the lowest REO sales total since Nov. 2014. The above graph indicates a significant jump in REO sales from October to November, but it’s more reflective of seasonal trends than an anomalous increase in distressed sales.

The share of short sales continued hovering around the 3 to 4 percent range, where the market has been since mid-2014.

CoreLogic researchers, while admitting “there will always be some level in distress in the housing market,” remain optimistic in their forecasts, predicting a continuing decline of distressed sales.

The report read: “If the current year-over-year decrease in the distressed sales share continues, it will reach that ‘normal’ 2-percent mark in mid-2019.”